Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 750 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about GreenTree Hospitality Group Ltd. (NYSE:GHG).

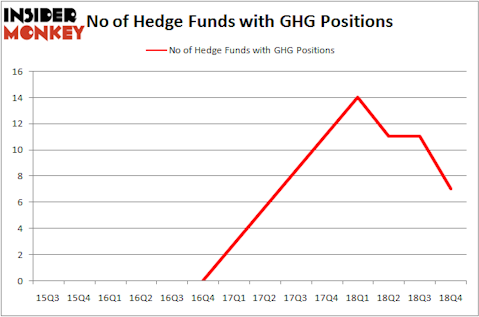

GreenTree Hospitality Group Ltd. (NYSE:GHG) has seen a decrease in enthusiasm from smart money in recent months. Our calculations also showed that GHG isn’t among the 30 most popular stocks among hedge funds.

To most stock holders, hedge funds are assumed to be slow, old investment vehicles of the past. While there are over 8000 funds trading at present, We choose to focus on the top tier of this club, about 750 funds. Most estimates calculate that this group of people administer bulk of the smart money’s total capital, and by paying attention to their first-class stock picks, Insider Monkey has come up with a few investment strategies that have historically outpaced the broader indices. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to take a look at the key hedge fund action regarding GreenTree Hospitality Group Ltd. (NYSE:GHG).

How are hedge funds trading GreenTree Hospitality Group Ltd. (NYSE:GHG)?

Heading into the first quarter of 2019, a total of 7 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -36% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards GHG over the last 14 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in GreenTree Hospitality Group Ltd. (NYSE:GHG) was held by Sylebra Capital Management, which reported holding $9.9 million worth of stock at the end of September. It was followed by Guardian Point Capital with a $4 million position. Other investors bullish on the company included Dalton Investments, Renaissance Technologies, and Driehaus Capital.

Because GreenTree Hospitality Group Ltd. (NYSE:GHG) has experienced declining sentiment from the aggregate hedge fund industry, it’s safe to say that there exists a select few hedge funds that elected to cut their positions entirely in the third quarter. Intriguingly, Sander Gerber’s Hudson Bay Capital Management sold off the biggest stake of all the hedgies tracked by Insider Monkey, worth close to $2.9 million in stock, and Michael R. Weisberg’s Crestwood Capital Management was right behind this move, as the fund cut about $2.5 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest was cut by 4 funds in the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to GreenTree Hospitality Group Ltd. (NYSE:GHG). These stocks are Plantronics, Inc. (NYSE:PLT), Autolus Therapeutics plc (NASDAQ:AUTL), Mallinckrodt plc (NYSE:MNK), and Instructure, Inc. (NYSE:INST). This group of stocks’ market valuations match GHG’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PLT | 16 | 72043 | -9 |

| AUTL | 6 | 408867 | -5 |

| MNK | 22 | 223543 | 2 |

| INST | 22 | 324837 | 4 |

| Average | 16.5 | 257323 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.5 hedge funds with bullish positions and the average amount invested in these stocks was $257 million. That figure was $18 million in GHG’s case. Mallinckrodt plc (NYSE:MNK) is the most popular stock in this table. On the other hand Autolus Therapeutics plc (NASDAQ:AUTL) is the least popular one with only 6 bullish hedge fund positions. GreenTree Hospitality Group Ltd. (NYSE:GHG) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately GHG wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); GHG investors were disappointed as the stock returned 14.3% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.