At Insider Monkey we follow nearly 750 of the best-performing investors and even though many of them lost money in the last couple of months of 2018 (some actually delivered very strong returns), the history teaches us that over the long-run they still manage to beat the market, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following some of their picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

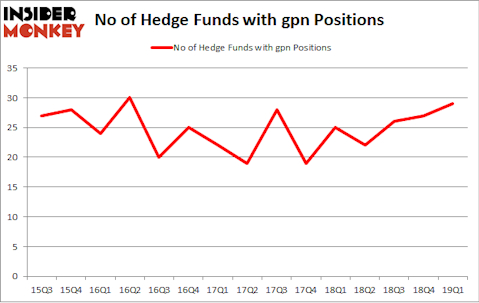

Is Global Payments Inc (NYSE:GPN) a superb investment now? The smart money is betting on the stock. The number of bullish hedge fund bets inched up by 2 in recent months. Our calculations also showed that gpn isn’t among the 30 most popular stocks among hedge funds. GPN was in 29 hedge funds’ portfolios at the end of March. There were 27 hedge funds in our database with GPN holdings at the end of the previous quarter.

In the financial world there are several tools market participants can use to analyze stocks. A couple of the most under-the-radar tools are hedge fund and insider trading activity. We have shown that, historically, those who follow the best picks of the top hedge fund managers can outclass the broader indices by a very impressive margin (see the details here).

We’re going to view the fresh hedge fund action surrounding Global Payments Inc (NYSE:GPN).

What have hedge funds been doing with Global Payments Inc (NYSE:GPN)?

At Q1’s end, a total of 29 of the hedge funds tracked by Insider Monkey were long this stock, a change of 7% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards GPN over the last 15 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Global Payments Inc (NYSE:GPN) was held by Alkeon Capital Management, which reported holding $140.1 million worth of stock at the end of March. It was followed by Polar Capital with a $62.9 million position. Other investors bullish on the company included Echo Street Capital Management, Engle Capital, and Adage Capital Management.

Consequently, key hedge funds were breaking ground themselves. Polar Capital, managed by Brian Ashford-Russell and Tim Woolley, initiated the most valuable position in Global Payments Inc (NYSE:GPN). Polar Capital had $62.9 million invested in the company at the end of the quarter. Phill Gross and Robert Atchinson’s Adage Capital Management also made a $47.5 million investment in the stock during the quarter. The following funds were also among the new GPN investors: James Parsons’s Junto Capital Management, Israel Englander’s Millennium Management, and Tor Minesuk’s Mondrian Capital.

Let’s now review hedge fund activity in other stocks similar to Global Payments Inc (NYSE:GPN). We will take a look at Interactive Brokers Group, Inc. (IEX:IBKR), Lululemon Athletica inc. (NASDAQ:LULU), Imperial Oil Limited (NYSE:IMO), and United Continental Holdings Inc (NASDAQ:UAL). This group of stocks’ market values are similar to GPN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IBKR | 23 | 940831 | 2 |

| LULU | 42 | 1770036 | 6 |

| IMO | 17 | 85055 | -2 |

| UAL | 49 | 6333893 | 0 |

| Average | 32.75 | 2282454 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32.75 hedge funds with bullish positions and the average amount invested in these stocks was $2282 million. That figure was $557 million in GPN’s case. United Continental Holdings Inc (NASDAQ:UAL) is the most popular stock in this table. On the other hand Imperial Oil Limited (NYSE:IMO) is the least popular one with only 17 bullish hedge fund positions. Global Payments Inc (NYSE:GPN) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on GPN as the stock returned 12% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.