How do we determine whether Genesee & Wyoming Inc (NYSE:GWR) makes for a good investment at the moment? We analyze the sentiment of a select group of the very best investors in the world, who spend immense amounts of time and resources studying companies. They may not always be right (no one is), but data shows that their consensus long positions have historically outperformed the market when we adjust for known risk factors.

Is Genesee & Wyoming Inc (NYSE:GWR) a worthy investment today? Prominent investors are buying. The number of bullish hedge fund positions inched up by 7 lately. Our calculations also showed that GWR isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to view the fresh hedge fund action regarding Genesee & Wyoming Inc (NYSE:GWR).

Hedge fund activity in Genesee & Wyoming Inc (NYSE:GWR)

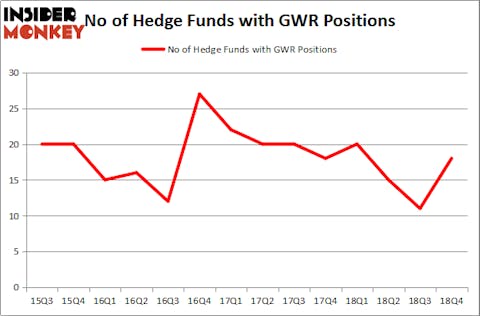

At Q4’s end, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 64% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards GWR over the last 14 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Genesee & Wyoming Inc (NYSE:GWR) was held by Blue Harbour Group, which reported holding $118.7 million worth of stock at the end of September. It was followed by Cardinal Capital with a $111 million position. Other investors bullish on the company included Goodnow Investment Group, Winton Capital Management, and Citadel Investment Group.

Now, some big names were leading the bulls’ herd. Citadel Investment Group, managed by Ken Griffin, assembled the largest position in Genesee & Wyoming Inc (NYSE:GWR). Citadel Investment Group had $9.8 million invested in the company at the end of the quarter. Joel Greenblatt’s Gotham Asset Management also made a $9.7 million investment in the stock during the quarter. The other funds with brand new GWR positions are Paul Singer’s Elliott Management, Dmitry Balyasny’s Balyasny Asset Management, and Israel Englander’s Millennium Management.

Let’s now review hedge fund activity in other stocks similar to Genesee & Wyoming Inc (NYSE:GWR). These stocks are AGCO Corporation (NYSE:AGCO), Lazard Ltd (NYSE:LAZ), Prosperity Bancshares, Inc. (NYSE:PB), and W.R. Grace & Co. (NYSE:GRA). This group of stocks’ market valuations are similar to GWR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AGCO | 32 | 238888 | 11 |

| LAZ | 16 | 481052 | -1 |

| PB | 9 | 53292 | 3 |

| GRA | 37 | 1688168 | 0 |

| Average | 23.5 | 615350 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.5 hedge funds with bullish positions and the average amount invested in these stocks was $615 million. That figure was $322 million in GWR’s case. W.R. Grace & Co. (NYSE:GRA) is the most popular stock in this table. On the other hand Prosperity Bancshares, Inc. (NYSE:PB) is the least popular one with only 9 bullish hedge fund positions. Genesee & Wyoming Inc (NYSE:GWR) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on GWR, though not to the same extent, as the stock returned 17% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.