Before putting in our own effort and resources into finding a good investment, we can quickly utilize hedge fund expertise to give us a quick glimpse of whether that stock could make for a good addition to our portfolios. The odds are not exactly stacked in investors’ favor when it comes to beating the market, as evidenced by the fact that less than 49% of the stocks in the S&P 500 did so during the second quarter. The stats were even worse in recent years when most of the advances in the market were due to large gains by FAANG stocks. However, one bright side for individual investors was the strong performance of hedge funds’ top consensus picks. This year hedge funds’ top 20 stock picks outperformed the S&P 500 Index by 6.6 percentage points through May 30th. Thus, we can see that the tireless research and efforts of hedge funds to identify winning stocks can work to our advantage when we know how to use the data. While not all of their picks will be winners, our odds are much better following their best stock picks than trying to go it alone.

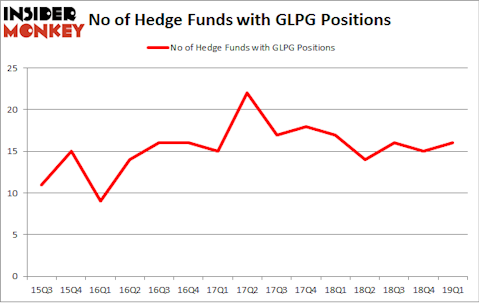

Is Galapagos NV (NASDAQ:GLPG) a good investment now? The smart money is buying. The number of bullish hedge fund bets advanced by 1 lately. Our calculations also showed that glpg isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a gander at the fresh hedge fund action surrounding Galapagos NV (NASDAQ:GLPG).

How have hedgies been trading Galapagos NV (NASDAQ:GLPG)?

At Q1’s end, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 7% from the previous quarter. By comparison, 17 hedge funds held shares or bullish call options in GLPG a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Cormorant Asset Management, managed by Bihua Chen, holds the largest position in Galapagos NV (NASDAQ:GLPG). Cormorant Asset Management has a $35 million position in the stock, comprising 2.4% of its 13F portfolio. Coming in second is Deerfield Management, managed by James E. Flynn, which holds a $20.8 million position; 0.8% of its 13F portfolio is allocated to the stock. Remaining professional money managers with similar optimism consist of Panayotis Takis Sparaggis’s Alkeon Capital Management, Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management and Jim Simons’s Renaissance Technologies.

As industrywide interest jumped, some big names have jumped into Galapagos NV (NASDAQ:GLPG) headfirst. Cormorant Asset Management, managed by Bihua Chen, established the largest position in Galapagos NV (NASDAQ:GLPG). Cormorant Asset Management had $35 million invested in the company at the end of the quarter. Panayotis Takis Sparaggis’s Alkeon Capital Management also initiated a $20.6 million position during the quarter. The other funds with new positions in the stock are Ken Griffin’s Citadel Investment Group, Mike Vranos’s Ellington, and Matthew Tewksbury’s Stevens Capital Management.

Let’s also examine hedge fund activity in other stocks similar to Galapagos NV (NASDAQ:GLPG). These stocks are Hubbell Incorporated (NYSE:HUBB), LATAM Airlines Group S.A. (NYSE:LTM), Autoliv Inc. (NYSE:ALV), and Planet Fitness Inc (NYSE:PLNT). This group of stocks’ market valuations are similar to GLPG’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HUBB | 21 | 357892 | -3 |

| LTM | 8 | 21281 | 0 |

| ALV | 13 | 444882 | 0 |

| PLNT | 25 | 498649 | -5 |

| Average | 16.75 | 330676 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $331 million. That figure was $131 million in GLPG’s case. Planet Fitness Inc (NYSE:PLNT) is the most popular stock in this table. On the other hand LATAM Airlines Group S.A. (NYSE:LTM) is the least popular one with only 8 bullish hedge fund positions. Galapagos NV (NASDAQ:GLPG) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on GLPG as the stock returned 7.1% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.