Is Franco-Nevada Corporation (NYSE:FNV) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

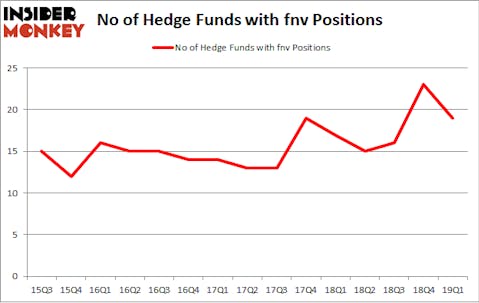

Franco-Nevada Corporation (NYSE:FNV) was in 19 hedge funds’ portfolios at the end of March. FNV has experienced a decrease in hedge fund sentiment of late. There were 23 hedge funds in our database with FNV holdings at the end of the previous quarter. Our calculations also showed that fnv isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a glance at the key hedge fund action surrounding Franco-Nevada Corporation (NYSE:FNV).

How have hedgies been trading Franco-Nevada Corporation (NYSE:FNV)?

Heading into the second quarter of 2019, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -17% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in FNV over the last 15 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Franco-Nevada Corporation (NYSE:FNV), with a stake worth $229.2 million reported as of the end of March. Trailing Renaissance Technologies was Horizon Asset Management, which amassed a stake valued at $73.7 million. AQR Capital Management, GLG Partners, and Royce & Associates were also very fond of the stock, giving the stock large weights in their portfolios.

Due to the fact that Franco-Nevada Corporation (NYSE:FNV) has faced declining sentiment from the smart money, it’s safe to say that there is a sect of fund managers who were dropping their full holdings by the end of the third quarter. Interestingly, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital said goodbye to the largest stake of the 700 funds followed by Insider Monkey, comprising close to $8.7 million in call options, and Benjamin A. Smith’s Laurion Capital Management was right behind this move, as the fund cut about $6.1 million worth. These transactions are important to note, as total hedge fund interest fell by 4 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks similar to Franco-Nevada Corporation (NYSE:FNV). We will take a look at Cincinnati Financial Corporation (NASDAQ:CINF), Host Hotels and Resorts Inc (NYSE:HST), Annaly Capital Management, Inc. (NYSE:NLY), and Western Digital Corporation (NASDAQ:WDC). This group of stocks’ market valuations resemble FNV’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CINF | 21 | 545563 | -1 |

| HST | 27 | 576569 | 5 |

| NLY | 21 | 339026 | 5 |

| WDC | 33 | 387729 | 8 |

| Average | 25.5 | 462222 | 4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.5 hedge funds with bullish positions and the average amount invested in these stocks was $462 million. That figure was $458 million in FNV’s case. Western Digital Corporation (NASDAQ:WDC) is the most popular stock in this table. On the other hand Cincinnati Financial Corporation (NASDAQ:CINF) is the least popular one with only 21 bullish hedge fund positions. Compared to these stocks Franco-Nevada Corporation (NYSE:FNV) is even less popular than CINF. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on FNV, though not to the same extent, as the stock returned -0.3% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.