How do we determine whether Forrester Research, Inc. (NASDAQ:FORR) makes for a good investment at the moment? We analyze the sentiment of a select group of the very best investors in the world, who spend immense amounts of time and resources studying companies. They may not always be right (no one is), but data shows that their consensus long positions have historically outperformed the market when we adjust for known risk factors.

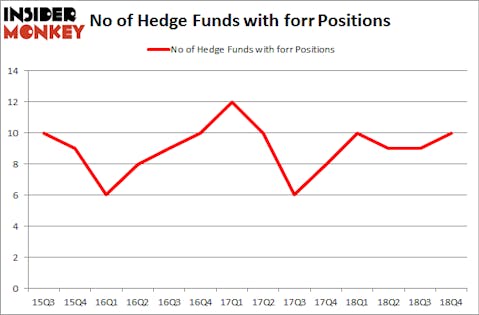

Forrester Research, Inc. (NASDAQ:FORR) was in 10 hedge funds’ portfolios at the end of the fourth quarter of 2018. FORR has experienced an increase in enthusiasm from smart money of late. There were 9 hedge funds in our database with FORR holdings at the end of the previous quarter. Our calculations also showed that forr isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are a multitude of tools stock traders use to size up their stock investments. A couple of the most useful tools are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the top picks of the best money managers can beat the market by a solid amount (see the details here).

We’re going to take a gander at the fresh hedge fund action encompassing Forrester Research, Inc. (NASDAQ:FORR).

What does the smart money think about Forrester Research, Inc. (NASDAQ:FORR)?

At the end of the fourth quarter, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 11% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in FORR over the last 14 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Forrester Research, Inc. (NASDAQ:FORR) was held by Renaissance Technologies, which reported holding $34.2 million worth of stock at the end of December. It was followed by ACK Asset Management with a $9.3 million position. Other investors bullish on the company included Millennium Management, GLG Partners, and Royce & Associates.

As industrywide interest jumped, specific money managers were breaking ground themselves. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, initiated the most valuable position in Forrester Research, Inc. (NASDAQ:FORR). Marshall Wace LLP had $0.1 million invested in the company at the end of the quarter.

Let’s now review hedge fund activity in other stocks similar to Forrester Research, Inc. (NASDAQ:FORR). We will take a look at Independence Realty Trust Inc (NYSE:IRT), Penn Virginia Corporation (NASDAQ:PVAC), Douglas Dynamics Inc (NYSE:PLOW), and Knoll Inc (NYSE:KNL). This group of stocks’ market values match FORR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IRT | 9 | 50885 | -2 |

| PVAC | 16 | 274325 | -5 |

| PLOW | 7 | 7515 | 1 |

| KNL | 22 | 60960 | 8 |

| Average | 13.5 | 98421 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $98 million. That figure was $53 million in FORR’s case. Knoll Inc (NYSE:KNL) is the most popular stock in this table. On the other hand Douglas Dynamics Inc (NYSE:PLOW) is the least popular one with only 7 bullish hedge fund positions. Forrester Research, Inc. (NASDAQ:FORR) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately FORR wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); FORR investors were disappointed as the stock returned 10.7% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.