At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

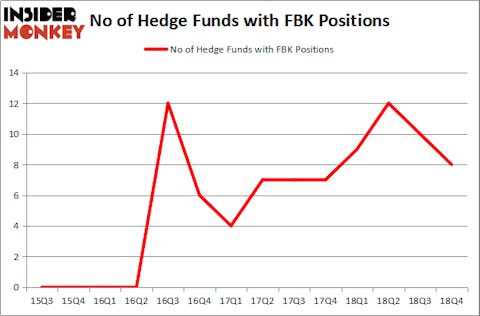

FB Financial Corporation (NYSE:FBK) has experienced a decrease in enthusiasm from smart money in recent months. FBK was in 8 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 10 hedge funds in our database with FBK holdings at the end of the previous quarter. Our calculations also showed that FBK isn’t among the 30 most popular stocks among hedge funds.

According to most market participants, hedge funds are seen as slow, outdated investment tools of yesteryear. While there are more than 8000 funds with their doors open today, We look at the leaders of this group, about 750 funds. These money managers watch over most of the hedge fund industry’s total capital, and by keeping track of their inimitable equity investments, Insider Monkey has identified many investment strategies that have historically outrun the market. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by nearly 5 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s take a look at the recent hedge fund action encompassing FB Financial Corporation (NYSE:FBK).

How are hedge funds trading FB Financial Corporation (NYSE:FBK)?

At the end of the fourth quarter, a total of 8 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -20% from the second quarter of 2018. On the other hand, there were a total of 9 hedge funds with a bullish position in FBK a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Mendon Capital Advisors held the most valuable stake in FB Financial Corporation (NYSE:FBK), which was worth $70.3 million at the end of the fourth quarter. On the second spot was Cardinal Capital which amassed $37.7 million worth of shares. Moreover, Forest Hill Capital, Renaissance Technologies, and Blue Mountain Capital were also bullish on FB Financial Corporation (NYSE:FBK), allocating a large percentage of their portfolios to this stock.

Seeing as FB Financial Corporation (NYSE:FBK) has faced bearish sentiment from hedge fund managers, we can see that there exists a select few hedge funds that slashed their positions entirely heading into Q3. It’s worth mentioning that Cliff Asness’s AQR Capital Management cut the largest stake of the “upper crust” of funds tracked by Insider Monkey, comprising an estimated $1.9 million in stock. Israel Englander’s fund, Millennium Management, also dropped its stock, about $1.5 million worth. These moves are interesting, as total hedge fund interest was cut by 2 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as FB Financial Corporation (NYSE:FBK) but similarly valued. These stocks are Dril-Quip, Inc. (NYSE:DRQ), Uniqure NV (NASDAQ:QURE), Presidio, Inc. (NASDAQ:PSDO), and Beneficial Bancorp, Inc. (NASDAQ:BNCL). This group of stocks’ market valuations resemble FBK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DRQ | 19 | 127024 | 1 |

| QURE | 17 | 279693 | -2 |

| PSDO | 6 | 4900 | -8 |

| BNCL | 12 | 81062 | 3 |

| Average | 13.5 | 123170 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $123 million. That figure was $116 million in FBK’s case. Dril-Quip, Inc. (NYSE:DRQ) is the most popular stock in this table. On the other hand Presidio, Inc. (NASDAQ:PSDO) is the least popular one with only 6 bullish hedge fund positions. FB Financial Corporation (NYSE:FBK) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately FBK wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); FBK investors were disappointed as the stock returned -2.1% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.