Concerns over rising interest rates and expected further rate increases have hit several stocks hard during the fourth quarter. NASDAQ and Russell 2000 indices were already in correction territory. More importantly, Russell 2000 ETF (IWM) underperformed the larger S&P 500 ETF (SPY) by nearly 7 percentage points in the fourth quarter. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were paring back their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards EnerSys (NYSE:ENS).

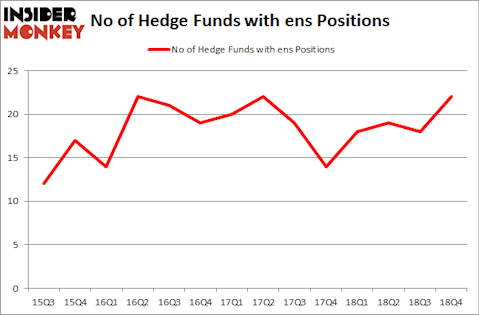

EnerSys (NYSE:ENS) was in 22 hedge funds’ portfolios at the end of the fourth quarter of 2018. ENS has experienced an increase in support from the world’s most elite money managers lately. There were 18 hedge funds in our database with ENS positions at the end of the previous quarter. Our calculations also showed that ens isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to check out the key hedge fund action encompassing EnerSys (NYSE:ENS).

What does the smart money think about EnerSys (NYSE:ENS)?

At Q4’s end, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 22% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards ENS over the last 14 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in EnerSys (NYSE:ENS) was held by AQR Capital Management, which reported holding $35.6 million worth of stock at the end of September. It was followed by ACK Asset Management with a $25.8 million position. Other investors bullish on the company included D E Shaw, Winton Capital Management, and Royce & Associates.

Consequently, specific money managers have been driving this bullishness. SG Capital Management, managed by Ken Grossman and Glen Schneider, established the most valuable position in EnerSys (NYSE:ENS). SG Capital Management had $5.2 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also initiated a $2.7 million position during the quarter. The following funds were also among the new ENS investors: Matthew Hulsizer’s PEAK6 Capital Management, Matthew Tewksbury’s Stevens Capital Management, and Minhua Zhang’s Weld Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as EnerSys (NYSE:ENS) but similarly valued. We will take a look at Olin Corporation (NYSE:OLN), Essent Group Ltd (NYSE:ESNT), Air Lease Corp (NYSE:AL), and Glacier Bancorp, Inc. (NASDAQ:GBCI). This group of stocks’ market valuations are similar to ENS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OLN | 33 | 638129 | 6 |

| ESNT | 28 | 369859 | -2 |

| AL | 33 | 321349 | 6 |

| GBCI | 10 | 41800 | 3 |

| Average | 26 | 342784 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26 hedge funds with bullish positions and the average amount invested in these stocks was $343 million. That figure was $132 million in ENS’s case. Olin Corporation (NYSE:OLN) is the most popular stock in this table. On the other hand Glacier Bancorp, Inc. (NASDAQ:GBCI) is the least popular one with only 10 bullish hedge fund positions. EnerSys (NYSE:ENS) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately ENS wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); ENS investors were disappointed as the stock returned -9.3% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.