It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. Since stock returns aren’t usually symmetrically distributed and index returns are more affected by a few outlier stocks (i.e. the FAANG stocks dominating and driving S&P 500 Index’s returns in recent years), more than 50% of the constituents of the Standard and Poor’s 500 Index underperform the benchmark. Hence, if you randomly pick a stock, there is more than 50% chance that you’d fail to beat the market. At the same time, the 15 most favored S&P 500 stocks by the hedge funds monitored by Insider Monkey generated a return of 19.7% during the first 2.5 months of 2019 (vs. 13.1% gain for SPY), with 93% of these stocks outperforming the benchmark. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Edgewell Personal Care Company (NYSE:EPC).

Hedge fund interest in Edgewell Personal Care Company (NYSE:EPC) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare EPC to other stocks including Mimecast Limited (NASDAQ:MIME), Colony Credit Real Estate, Inc. (NYSE:CLNC), and Livent Corporation (NYSE:LTHM) to get a better sense of its popularity.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to review the new hedge fund action surrounding Edgewell Personal Care Company (NYSE:EPC).

What have hedge funds been doing with Edgewell Personal Care Company (NYSE:EPC)?

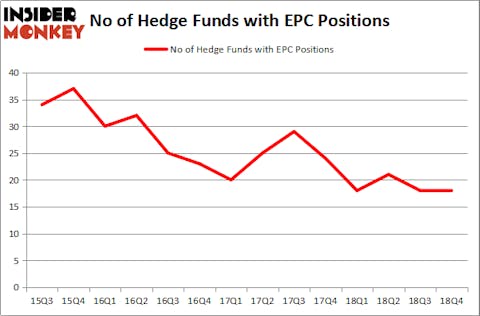

At Q4’s end, a total of 18 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards EPC over the last 14 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

Among these funds, GAMCO Investors held the most valuable stake in Edgewell Personal Care Company (NYSE:EPC), which was worth $54.8 million at the end of December. On the second spot was Legion Partners Asset Management which amassed $41.9 million worth of shares. Moreover, Armistice Capital, Gotham Asset Management, and Arrowstreet Capital were also bullish on Edgewell Personal Care Company (NYSE:EPC), allocating a large percentage of their portfolios to this stock.

Because Edgewell Personal Care Company (NYSE:EPC) has faced bearish sentiment from the entirety of the hedge funds we track, logic holds that there were a few fund managers who sold off their positions entirely by the end of the third quarter. It’s worth mentioning that Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital cut the biggest investment of the “upper crust” of funds monitored by Insider Monkey, valued at an estimated $3.6 million in stock, and David Harding’s Winton Capital Management was right behind this move, as the fund cut about $3.3 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks similar to Edgewell Personal Care Company (NYSE:EPC). These stocks are Mimecast Limited (NASDAQ:MIME), Colony Credit Real Estate, Inc. (NYSE:CLNC), Livent Corporation (NYSE:LTHM), and CenterState Bank Corporation (NASDAQ:CSFL). All of these stocks’ market caps resemble EPC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MIME | 23 | 427545 | -3 |

| CLNC | 7 | 19539 | 3 |

| LTHM | 10 | 124151 | 10 |

| CSFL | 20 | 109125 | 1 |

| Average | 15 | 170090 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $170 million. That figure was $188 million in EPC’s case. Mimecast Limited (NASDAQ:MIME) is the most popular stock in this table. On the other hand Colony Credit Real Estate, Inc. (NYSE:CLNC) is the least popular one with only 7 bullish hedge fund positions. Edgewell Personal Care Company (NYSE:EPC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately EPC wasn’t nearly as popular as these 15 stock and hedge funds that were betting on EPC were disappointed as the stock returned 13.7% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.