Based on the fact that hedge funds have collectively under-performed the market for several years, it would be easy to assume that their stock picks simply aren’t very good. However, our research shows this not to be the case. In fact, when it comes to their very top picks collectively, they show a strong ability to pick winning stocks. This year hedge funds’ top 20 stock picks easily bested the broader market, at 18.7% compared to 12.1%, despite there being a few duds in there like Berkshire Hathaway (even their collective wisdom isn’t perfect). The results show that there is plenty of merit to imitating the collective wisdom of top investors.

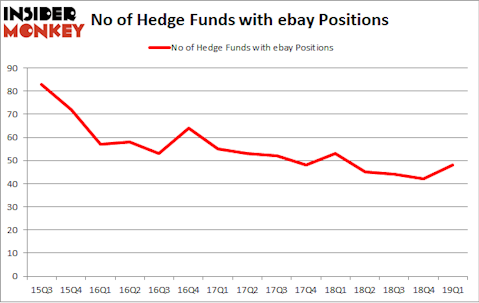

Is eBay Inc (NASDAQ:EBAY) a buy, sell, or hold? Hedge funds are in an optimistic mood. The number of long hedge fund positions rose by 6 lately. Our calculations also showed that ebay isn’t among the 30 most popular stocks among hedge funds. EBAY was in 48 hedge funds’ portfolios at the end of the first quarter of 2019. There were 42 hedge funds in our database with EBAY holdings at the end of the previous quarter.

If you’d ask most stock holders, hedge funds are seen as worthless, outdated investment vehicles of years past. While there are greater than 8000 funds in operation at present, We hone in on the crème de la crème of this club, approximately 750 funds. These investment experts have their hands on most of the hedge fund industry’s total capital, and by shadowing their first-class stock picks, Insider Monkey has identified a number of investment strategies that have historically beaten Mr. Market. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by around 5 percentage points per annum since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

We’re going to view the key hedge fund action encompassing eBay Inc (NASDAQ:EBAY).

What does the smart money think about eBay Inc (NASDAQ:EBAY)?

At Q1’s end, a total of 48 of the hedge funds tracked by Insider Monkey were long this stock, a change of 14% from the previous quarter. The graph below displays the number of hedge funds with bullish position in EBAY over the last 15 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

Among these funds, Baupost Group held the most valuable stake in eBay Inc (NASDAQ:EBAY), which was worth $1087.7 million at the end of the first quarter. On the second spot was D E Shaw which amassed $480.6 million worth of shares. Moreover, Elliott Management, Two Sigma Advisors, and Starboard Value LP were also bullish on eBay Inc (NASDAQ:EBAY), allocating a large percentage of their portfolios to this stock.

Now, key hedge funds were breaking ground themselves. Elliott Management, managed by Paul Singer, created the most valuable position in eBay Inc (NASDAQ:EBAY). Elliott Management had $367.7 million invested in the company at the end of the quarter. Jeffrey Smith’s Starboard Value LP also initiated a $233.5 million position during the quarter. The other funds with new positions in the stock are Jim Simons’s Renaissance Technologies, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Alexander Mitchell’s Scopus Asset Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as eBay Inc (NASDAQ:EBAY) but similarly valued. We will take a look at Johnson Controls International plc (NYSE:JCI), Constellation Brands, Inc. (NYSE:STZ), Manulife Financial Corporation (NYSE:MFC), and Canadian Natural Resources Limited (NYSE:CNQ). All of these stocks’ market caps are closest to EBAY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JCI | 25 | 727926 | -1 |

| STZ | 38 | 2547745 | -24 |

| MFC | 16 | 323863 | -4 |

| CNQ | 29 | 643752 | 5 |

| Average | 27 | 1060822 | -6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27 hedge funds with bullish positions and the average amount invested in these stocks was $1061 million. That figure was $3934 million in EBAY’s case. Constellation Brands, Inc. (NYSE:STZ) is the most popular stock in this table. On the other hand Manulife Financial Corporation (NYSE:MFC) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks eBay Inc (NASDAQ:EBAY) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately EBAY wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on EBAY were disappointed as the stock returned -1.7% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.