During the fourth quarter the Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by nearly 7 percentage points as investors worried over the possible ramifications of rising interest rates. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of e.l.f. Beauty, Inc. (NYSE:ELF) and see how the stock is affected by the recent hedge fund activity.

Is e.l.f. Beauty, Inc. (NYSE:ELF) a buy right now? Prominent investors are turning bullish. The number of bullish hedge fund positions inched up by 6 recently. Our calculations also showed that ELF isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are plenty of gauges shareholders put to use to appraise their stock investments. A pair of the most useful gauges are hedge fund and insider trading moves. We have shown that, historically, those who follow the best picks of the elite hedge fund managers can outperform the broader indices by a very impressive margin (see the details here).

We’re going to take a look at the new hedge fund action encompassing e.l.f. Beauty, Inc. (NYSE:ELF).

What does the smart money think about e.l.f. Beauty, Inc. (NYSE:ELF)?

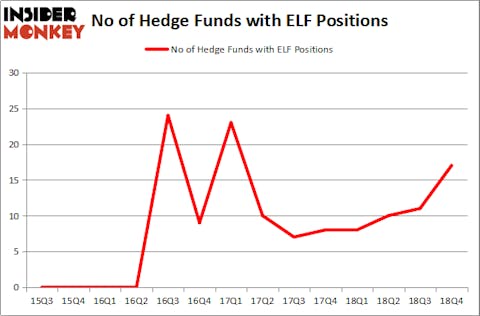

At Q4’s end, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 55% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ELF over the last 14 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Marathon Partners held the most valuable stake in e.l.f. Beauty, Inc. (NYSE:ELF), which was worth $35.9 million at the end of the fourth quarter. On the second spot was Bares Capital Management which amassed $14.7 million worth of shares. Moreover, Portolan Capital Management, Millennium Management, and Marshall Wace LLP were also bullish on e.l.f. Beauty, Inc. (NYSE:ELF), allocating a large percentage of their portfolios to this stock.

With a general bullishness amongst the heavyweights, some big names were leading the bulls’ herd. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, assembled the largest position in e.l.f. Beauty, Inc. (NYSE:ELF). Arrowstreet Capital had $0.4 million invested in the company at the end of the quarter. John Overdeck and David Siegel’s Two Sigma Advisors also made a $0.4 million investment in the stock during the quarter. The other funds with brand new ELF positions are Phil Frohlich’s Prescott Group Capital Management, Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, and Jeffrey Moskowitz’s Harvey Partners.

Let’s also examine hedge fund activity in other stocks similar to e.l.f. Beauty, Inc. (NYSE:ELF). We will take a look at Mitek Systems, Inc. (NASDAQ:MITK), Scorpio Bulkers Inc (NYSE:SALT), Arvinas, Inc. (NASDAQ:ARVN), and Model N Inc (NYSE:MODN). This group of stocks’ market caps are closest to ELF’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MITK | 15 | 31983 | 3 |

| SALT | 9 | 57971 | -1 |

| ARVN | 14 | 101574 | -3 |

| MODN | 14 | 66447 | 0 |

| Average | 13 | 64494 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13 hedge funds with bullish positions and the average amount invested in these stocks was $64 million. That figure was $77 million in ELF’s case. Mitek Systems, Inc. (NASDAQ:MITK) is the most popular stock in this table. On the other hand Scorpio Bulkers Inc (NYSE:SALT) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks e.l.f. Beauty, Inc. (NYSE:ELF) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on ELF as the stock returned 41.1% and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.