At Insider Monkey, we pore over the filings of nearly 750 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of March 31. In this article, we will use that wealth of knowledge to determine whether or not Domino’s Pizza, Inc. (NYSE:DPZ) makes for a good investment right now.

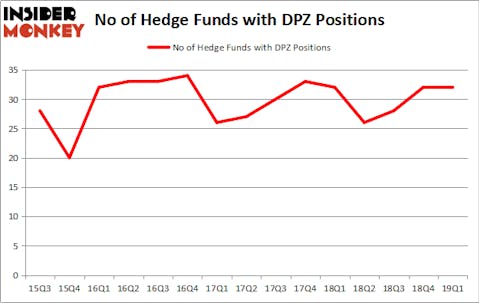

Domino’s Pizza, Inc. (NYSE:DPZ) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 32 hedge funds’ portfolios at the end of the first quarter of 2019. At the end of this article we will also compare DPZ to other stocks including Micro Focus Intl PLC (NYSE:MFGP), Wheaton Precious Metals Corp. (NYSE:WPM), and TechnipFMC plc (NYSE:FTI) to get a better sense of its popularity.

In the financial world there are several signals stock market investors can use to grade stocks. A pair of the best signals are hedge fund and insider trading interest. We have shown that, historically, those who follow the top picks of the elite fund managers can outclass the S&P 500 by a significant margin (see the details here).

We’re going to go over the recent hedge fund action encompassing Domino’s Pizza, Inc. (NYSE:DPZ).

How are hedge funds trading Domino’s Pizza, Inc. (NYSE:DPZ)?

At Q1’s end, a total of 32 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards DPZ over the last 15 quarters. With the smart money’s capital changing hands, there exists a select group of noteworthy hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Renaissance Technologies, managed by Jim Simons, holds the largest position in Domino’s Pizza, Inc. (NYSE:DPZ). Renaissance Technologies has a $715.8 million position in the stock, comprising 0.7% of its 13F portfolio. Coming in second is Tiger Global Management, led by Chase Coleman, holding a $316.1 million position; the fund has 1.7% of its 13F portfolio invested in the stock. Some other members of the smart money with similar optimism comprise Ken Griffin’s Citadel Investment Group, Ken Fisher’s Fisher Asset Management and Gabriel Plotkin’s Melvin Capital Management.

Because Domino’s Pizza, Inc. (NYSE:DPZ) has experienced a decline in interest from hedge fund managers, logic holds that there is a sect of hedgies that decided to sell off their positions entirely by the end of the third quarter. Intriguingly, James Parsons’s Junto Capital Management said goodbye to the biggest investment of the 700 funds tracked by Insider Monkey, totaling close to $50.7 million in stock. Richard Chilton’s fund, Chilton Investment Company, also cut its stock, about $40.6 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks similar to Domino’s Pizza, Inc. (NYSE:DPZ). These stocks are Micro Focus Intl PLC (NYSE:MFGP), Wheaton Precious Metals Corp. (NYSE:WPM), TechnipFMC plc (NYSE:FTI), and Ubiquiti Networks Inc (NASDAQ:UBNT). This group of stocks’ market caps are closest to DPZ’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MFGP | 4 | 37735 | -4 |

| WPM | 19 | 324663 | -2 |

| FTI | 25 | 617440 | 4 |

| UBNT | 17 | 668120 | -2 |

| Average | 16.25 | 411990 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.25 hedge funds with bullish positions and the average amount invested in these stocks was $412 million. That figure was $1861 million in DPZ’s case. TechnipFMC plc (NYSE:FTI) is the most popular stock in this table. On the other hand Micro Focus Intl PLC (NYSE:MFGP) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Domino’s Pizza, Inc. (NYSE:DPZ) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on DPZ as the stock returned 7.4% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.