The first quarter was a breeze as Powell pivoted, and China seemed eager to reach a deal with Trump. Both the S&P 500 and Russell 2000 delivered very strong gains as a result, with the Russell 2000, which is composed of smaller companies, outperforming the large-cap stocks slightly during the first quarter. Unfortunately sentiment shifted in May as this time China pivoted and Trump put more pressure on China by increasing tariffs. Hedge funds’ top 20 stock picks performed spectacularly in this volatile environment. These stocks delivered a total gain of 18.7% through May 30th, vs. a gain of 12.1% for the S&P 500 ETF. In this article we will look at how this market volatility affected the sentiment of hedge funds towards Dillard’s, Inc. (NYSE:DDS), and what that likely means for the prospects of the company and its stock.

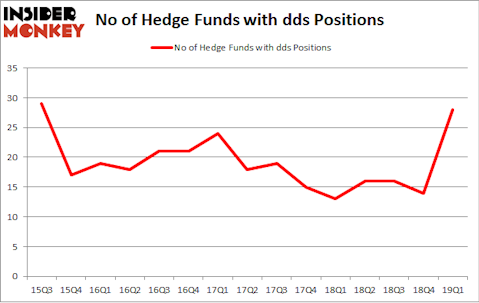

Dillard’s, Inc. (NYSE:DDS) investors should pay attention to an increase in enthusiasm from smart money recently. DDS was in 28 hedge funds’ portfolios at the end of the first quarter of 2019. There were 14 hedge funds in our database with DDS holdings at the end of the previous quarter. Our calculations also showed that dds isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s check out the recent hedge fund action surrounding Dillard’s, Inc. (NYSE:DDS).

How are hedge funds trading Dillard’s, Inc. (NYSE:DDS)?

At the end of the first quarter, a total of 28 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 100% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in DDS over the last 15 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Cliff Asness’s AQR Capital Management has the number one position in Dillard’s, Inc. (NYSE:DDS), worth close to $54.8 million, corresponding to 0.1% of its total 13F portfolio. Coming in second is D E Shaw, led by D. E. Shaw, holding a $15 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other members of the smart money that are bullish consist of Lee Ainslie’s Maverick Capital, Ken Griffin’s Citadel Investment Group and Paul Marshall and Ian Wace’s Marshall Wace LLP.

As aggregate interest increased, key hedge funds were leading the bulls’ herd. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, created the biggest position in Dillard’s, Inc. (NYSE:DDS). Marshall Wace LLP had $12.5 million invested in the company at the end of the quarter. Jim Simons’s Renaissance Technologies also initiated a $6.3 million position during the quarter. The other funds with new positions in the stock are John Overdeck and David Siegel’s Two Sigma Advisors, Steve Cohen’s Point72 Asset Management, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Let’s now take a look at hedge fund activity in other stocks similar to Dillard’s, Inc. (NYSE:DDS). We will take a look at International Speedway Corporation (NASDAQ:ISCA), Crocs, Inc. (NASDAQ:CROX), Capitol Federal Financial, Inc. (NASDAQ:CFFN), and SPS Commerce, Inc. (NASDAQ:SPSC). This group of stocks’ market values are closest to DDS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ISCA | 19 | 167619 | -1 |

| CROX | 25 | 393812 | -1 |

| CFFN | 11 | 157223 | 2 |

| SPSC | 19 | 175243 | 0 |

| Average | 18.5 | 223474 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.5 hedge funds with bullish positions and the average amount invested in these stocks was $223 million. That figure was $155 million in DDS’s case. Crocs, Inc. (NASDAQ:CROX) is the most popular stock in this table. On the other hand Capitol Federal Financial, Inc. (NASDAQ:CFFN) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Dillard’s, Inc. (NYSE:DDS) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately DDS wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on DDS were disappointed as the stock returned -21.8% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.