Is DiamondRock Hospitality Company (NYSE:DRH) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to find the winners in the stock market.

Is DiamondRock Hospitality Company (NYSE:DRH) a buy, sell, or hold? Hedge funds are betting on the stock. The number of bullish hedge fund positions advanced by 10 recently. Our calculations also showed that drh isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are numerous tools shareholders can use to evaluate their holdings. A couple of the less known tools are hedge fund and insider trading activity. We have shown that, historically, those who follow the best picks of the top investment managers can trounce the market by a solid amount (see the details here).

Let’s take a look at the recent hedge fund action regarding DiamondRock Hospitality Company (NYSE:DRH).

How are hedge funds trading DiamondRock Hospitality Company (NYSE:DRH)?

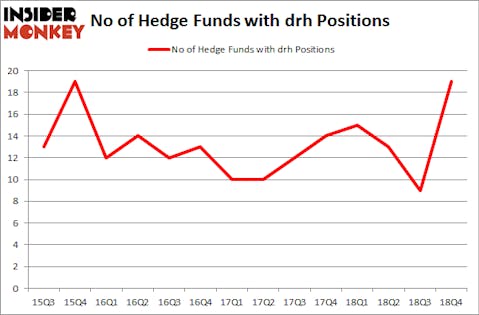

At Q4’s end, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 111% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards DRH over the last 14 quarters. With hedge funds’ capital changing hands, there exists a few notable hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

Among these funds, HG Vora Capital Management held the most valuable stake in DiamondRock Hospitality Company (NYSE:DRH), which was worth $81.7 million at the end of the third quarter. On the second spot was Long Pond Capital which amassed $21.7 million worth of shares. Moreover, Balyasny Asset Management, Pzena Investment Management, and Two Sigma Advisors were also bullish on DiamondRock Hospitality Company (NYSE:DRH), allocating a large percentage of their portfolios to this stock.

Now, key money managers have been driving this bullishness. HG Vora Capital Management, managed by Parag Vora, created the biggest position in DiamondRock Hospitality Company (NYSE:DRH). HG Vora Capital Management had $81.7 million invested in the company at the end of the quarter. John Khoury’s Long Pond Capital also made a $21.7 million investment in the stock during the quarter. The following funds were also among the new DRH investors: D. E. Shaw’s D E Shaw, Eduardo Abush’s Waterfront Capital Partners, and Israel Englander’s Millennium Management.

Let’s check out hedge fund activity in other stocks similar to DiamondRock Hospitality Company (NYSE:DRH). These stocks are Taylor Morrison Home Corp (NYSE:TMHC), Medpace Holdings, Inc. (NASDAQ:MEDP), Commercial Metals Company (NYSE:CMC), and Brooks Automation, Inc. (NASDAQ:BRKS). This group of stocks’ market values are closest to DRH’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TMHC | 15 | 219436 | -6 |

| MEDP | 23 | 170623 | -3 |

| CMC | 17 | 196848 | -1 |

| BRKS | 9 | 70789 | -3 |

| Average | 16 | 164424 | -3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $164 million. That figure was $167 million in DRH’s case. Medpace Holdings, Inc. (NASDAQ:MEDP) is the most popular stock in this table. On the other hand Brooks Automation, Inc. (NASDAQ:BRKS) is the least popular one with only 9 bullish hedge fund positions. DiamondRock Hospitality Company (NYSE:DRH) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on DRH, though not to the same extent, as the stock returned 20.3% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.