It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. The Standard and Poor’s 500 Index returned 7.6% over the 12-month period ending November 21, while more than 51% of the constituents of the index underperformed the benchmark. Hence, a random stock picking process will most likely lead to disappointment. At the same time, the 30 most favored mid-cap stocks by the best performing hedge funds monitored by Insider Monkey generated a return of 18% over the same time span. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Cowen Group Inc (NASDAQ:COWN).

Among the funds we track, 10 funds disclosed long positions in Cowen Group Inc (NASDAQ:COWN) as of the end of September. COWN investors should be aware of a slight decrease in support from the world’s most successful money managers lately. At the end of this article we will also compare COWN to other stocks including Guaranty Bancorp (NASDAQ:GBNK), Ascendis Pharma A/S (NASDAQ:ASND), and Overstock.com, Inc. (NASDAQ:OSTK) to get a better sense of its popularity.

Follow Cowen Inc. (NASDAQ:COWN)

Follow Cowen Inc. (NASDAQ:COWN)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

With all of this in mind, we’re going to review the key action regarding Cowen Group Inc (NASDAQ:COWN).

What does the smart money think about Cowen Group Inc (NASDAQ:COWN)?

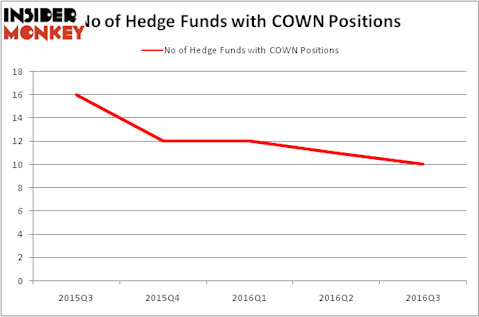

Heading into the fourth quarter of 2016, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, compared to 11 funds at the end of June. The graph below displays the number of hedge funds with bullish position in COWN over the last five quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, John W. Rogers’ Ariel Investments has the biggest position in Cowen Group Inc (NASDAQ:COWN), worth close to $44 million, amounting to 0.5% of its total 13F portfolio. Sitting at the No. 2 spot is Debra Fine of Fine Capital Partners, with a $38.4 million position; the fund has 3.9% of its 13F portfolio invested in the stock. Other peers that are bullish encompass Paul J. Isaac’s Arbiter Partners Capital Management, Chuck Royce’s Royce & Associates, and D E Shaw, one of the biggest hedge funds in the world. We should note that Arbiter Partners Capital Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Mendon Capital Advisors. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because none of the 700+ hedge funds tracked by Insider Monkey identified COWN as a viable investment and initiated a position in the stock.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Cowen Group Inc (NASDAQ:COWN) but similarly valued. These stocks are Guaranty Bancorp (NASDAQ:GBNK), Ascendis Pharma A/S (NASDAQ:ASND), Overstock.com, Inc. (NASDAQ:OSTK), and Myers Industries, Inc. (NYSE:MYE). This group of stocks’ market caps resemble COWN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GBNK | 10 | 69502 | 0 |

| ASND | 12 | 154777 | 1 |

| OSTK | 12 | 83600 | 0 |

| MYE | 9 | 68835 | 0 |

As you can see these stocks had an average of 11 funds with long positions and the average amount invested in these stocks was $94 million. That figure was $120 million in COWN’s case. Ascendis Pharma A/S (NASDAQ:ASND) is the most popular stock in this table. On the other hand Myers Industries, Inc. (NYSE:MYE) is the least popular one with only nine bullish hedge fund positions. Cowen Group Inc (NASDAQ:COWN) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard Ascendis Pharma A/S (NASDAQ:ASND) might be a better candidate to consider taking a long position in.

Disclosure: none