Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by nearly 9 percentage points since the end of the third quarter of 2018 as investors worried over the possible ramifications of rising interest rates and escalation of the trade war with China. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Controladora Vuela Co Avcn SA CV (NYSE:VLRS) and see how the stock is affected by the recent hedge fund activity.

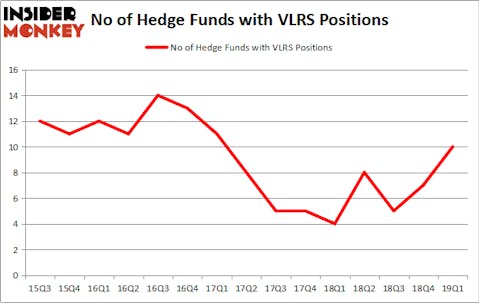

Controladora Vuela Co Avcn SA CV (NYSE:VLRS) was in 10 hedge funds’ portfolios at the end of March. VLRS has seen an increase in support from the world’s most elite money managers of late. There were 7 hedge funds in our database with VLRS holdings at the end of the previous quarter. Our calculations also showed that VLRS isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most shareholders, hedge funds are seen as slow, old investment tools of yesteryear. While there are more than 8000 funds with their doors open today, Our researchers hone in on the bigwigs of this club, around 750 funds. These hedge fund managers oversee the majority of all hedge funds’ total asset base, and by following their unrivaled stock picks, Insider Monkey has brought to light various investment strategies that have historically outstripped Mr. Market. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by around 5 percentage points a year since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Let’s take a gander at the key hedge fund action regarding Controladora Vuela Co Avcn SA CV (NYSE:VLRS).

What have hedge funds been doing with Controladora Vuela Co Avcn SA CV (NYSE:VLRS)?

Heading into the second quarter of 2019, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of 43% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in VLRS over the last 15 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Teewinot Capital Advisers was the largest shareholder of Controladora Vuela Co Avcn SA CV (NYSE:VLRS), with a stake worth $40.1 million reported as of the end of March. Trailing Teewinot Capital Advisers was Tiger Management, which amassed a stake valued at $18.1 million. Driehaus Capital, PAR Capital Management, and Renaissance Technologies were also very fond of the stock, giving the stock large weights in their portfolios.

Now, key hedge funds have been driving this bullishness. Driehaus Capital, managed by Richard Driehaus, established the most valuable position in Controladora Vuela Co Avcn SA CV (NYSE:VLRS). Driehaus Capital had $9.2 million invested in the company at the end of the quarter. Michael R. Weisberg’s Crestwood Capital Management also initiated a $1 million position during the quarter. The other funds with brand new VLRS positions are Noam Gottesman’s GLG Partners, Matthew Hulsizer’s PEAK6 Capital Management, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Controladora Vuela Co Avcn SA CV (NYSE:VLRS) but similarly valued. These stocks are X Financial (NYSE:XYF), Astec Industries, Inc. (NASDAQ:ASTE), AngioDynamics, Inc. (NASDAQ:ANGO), and Diebold Nixdorf Incorporated (NYSE:DBD). This group of stocks’ market values are similar to VLRS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XYF | 2 | 4088 | 0 |

| ASTE | 11 | 79116 | 1 |

| ANGO | 13 | 43616 | 1 |

| DBD | 18 | 166306 | 7 |

| Average | 11 | 73282 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11 hedge funds with bullish positions and the average amount invested in these stocks was $73 million. That figure was $88 million in VLRS’s case. Diebold Nixdorf Incorporated (NYSE:DBD) is the most popular stock in this table. On the other hand X Financial (NYSE:XYF) is the least popular one with only 2 bullish hedge fund positions. Controladora Vuela Co Avcn SA CV (NYSE:VLRS) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on VLRS as the stock returned 20.1% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.