Hedge funds are known to underperform the bull markets but that’s not because they are terrible at stock picking. Hedge funds underperform because their net exposure in only 40-70% and they charge exorbitant fees. No one knows what the future holds and how market participants will react to the bountiful news that floods in each day. However, hedge funds’ consensus picks on average deliver market beating returns. For example in the first 2.5 months of this year the Standard and Poor’s 500 Index returned approximately 13.1% (including dividend payments). Conversely, hedge funds’ top 15 large-cap stock picks generated a return of 19.7% during the same 2.5-month period, with 93% of these stock picks outperforming the broader market benchmark. Interestingly, an average long/short hedge fund returned only 5% due to the hedges they implemented and the large fees they charged. If you pay attention to the actual hedge fund returns (5%) versus the returns of their long stock picks, you might believe that it is a waste of time to analyze hedge funds’ purchases. We know better. That’s why we scrutinize hedge fund sentiment before we invest in a stock like Colony Capital Inc (NYSE:CLNY).

Colony Capital Inc (NYSE:CLNY) has experienced an increase in activity from the world’s largest hedge funds in recent months. CLNY was in 26 hedge funds’ portfolios at the end of December. There were 25 hedge funds in our database with CLNY positions at the end of the previous quarter. Our calculations also showed that CLNY isn’t among the 30 most popular stocks among hedge funds.

To most shareholders, hedge funds are perceived as underperforming, outdated financial vehicles of yesteryear. While there are more than 8000 funds trading at present, Our researchers hone in on the aristocrats of this club, about 750 funds. These money managers orchestrate bulk of the hedge fund industry’s total asset base, and by shadowing their inimitable stock picks, Insider Monkey has uncovered many investment strategies that have historically outpaced the S&P 500 index. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by nearly 5 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s take a peek at the key hedge fund action regarding Colony Capital Inc (NYSE:CLNY).

What have hedge funds been doing with Colony Capital Inc (NYSE:CLNY)?

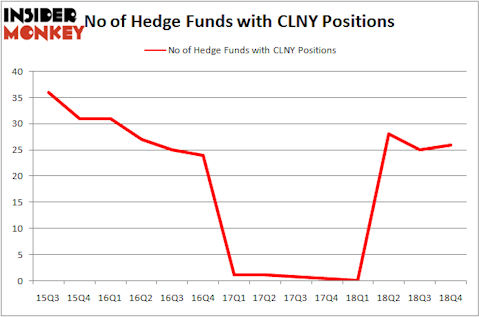

At Q4’s end, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 4% from the previous quarter. The graph below displays the number of hedge funds with bullish position in CLNY over the last 14 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Colony Capital Inc (NYSE:CLNY) was held by Baupost Group, which reported holding $232.5 million worth of stock at the end of September. It was followed by D E Shaw with a $21.4 million position. Other investors bullish on the company included Tensile Capital, Odey Asset Management Group, and HBK Investments.

As one would reasonably expect, key money managers have jumped into Colony Capital Inc (NYSE:CLNY) headfirst. Citadel Investment Group, managed by Ken Griffin, assembled the most valuable position in Colony Capital Inc (NYSE:CLNY). Citadel Investment Group had $14 million invested in the company at the end of the quarter. Kenneth Tropin’s Graham Capital Management also made a $11.2 million investment in the stock during the quarter. The following funds were also among the new CLNY investors: David Costen Haley’s HBK Investments, Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital, and Jeffrey Talpins’s Element Capital Management.

Let’s now take a look at hedge fund activity in other stocks similar to Colony Capital Inc (NYSE:CLNY). These stocks are Viavi Solutions Inc (NASDAQ:VIAV), Cleveland-Cliffs Inc (NYSE:CLF), California Water Service Group (NYSE:CWT), and Corporate Office Properties Trust (NYSE:OFC). This group of stocks’ market valuations are closest to CLNY’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VIAV | 26 | 175280 | 4 |

| CLF | 29 | 314934 | 4 |

| CWT | 8 | 25843 | 5 |

| OFC | 23 | 137135 | 13 |

| Average | 21.5 | 163298 | 6.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.5 hedge funds with bullish positions and the average amount invested in these stocks was $163 million. That figure was $334 million in CLNY’s case. Cleveland-Cliffs Inc (NYSE:CLF) is the most popular stock in this table. On the other hand California Water Service Group (NYSE:CWT) is the least popular one with only 8 bullish hedge fund positions. Colony Capital Inc (NYSE:CLNY) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately CLNY wasn’t nearly as popular as these 15 stock and hedge funds that were betting on CLNY were disappointed as the stock returned 11.4% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.