Before we spend days researching a stock idea we’d like to take a look at how hedge funds and billionaire investors recently traded that stock. S&P 500 Index ETF (SPY) lost 2.6% in the first two months of the second quarter. Ten out of 11 industry groups in the S&P 500 Index lost value in May. The average return of a randomly picked stock in the index was even worse (-3.6%). This means you (or a monkey throwing a dart) have less than an even chance of beating the market by randomly picking a stock. On the other hand, the top 20 most popular S&P 500 stocks among hedge funds not only generated positive returns but also outperformed the index by about 3 percentage points through May 30th. In this article, we will take a look at what hedge funds think about Colfax Corporation (NYSE:CFX).

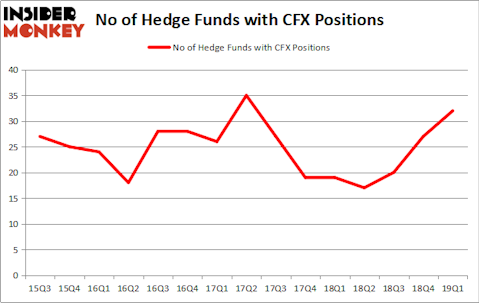

Colfax Corporation (NYSE:CFX) has experienced an increase in enthusiasm from smart money recently. Our calculations also showed that CFX isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a gander at the latest hedge fund action surrounding Colfax Corporation (NYSE:CFX).

What does the smart money think about Colfax Corporation (NYSE:CFX)?

At Q1’s end, a total of 32 of the hedge funds tracked by Insider Monkey were long this stock, a change of 19% from the fourth quarter of 2018. On the other hand, there were a total of 19 hedge funds with a bullish position in CFX a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Select Equity Group, managed by Robert Joseph Caruso, holds the largest position in Colfax Corporation (NYSE:CFX). Select Equity Group has a $76.2 million position in the stock, comprising 0.5% of its 13F portfolio. The second most bullish fund manager is Charles Davidson and Joseph Jacobs of Wexford Capital, with a $62.5 million position; 5.2% of its 13F portfolio is allocated to the company. Other members of the smart money that hold long positions encompass Ric Dillon’s Diamond Hill Capital, Dan Loeb’s Third Point and Chuck Royce’s Royce & Associates.

With a general bullishness amongst the heavyweights, some big names have been driving this bullishness. Third Point, managed by Dan Loeb, established the most valuable position in Colfax Corporation (NYSE:CFX). Third Point had $59.4 million invested in the company at the end of the quarter. Michael Platt and William Reeves’s BlueCrest Capital Mgmt. also made a $48.9 million investment in the stock during the quarter. The following funds were also among the new CFX investors: D. E. Shaw’s D E Shaw, David Rosen’s Rubric Capital Management, and Jeff Lignelli’s Incline Global Management.

Let’s now review hedge fund activity in other stocks similar to Colfax Corporation (NYSE:CFX). We will take a look at LHC Group, Inc. (NASDAQ:LHCG), Echostar Corporation (NASDAQ:SATS), Sabra Health Care REIT Inc (NASDAQ:SBRA), and Rexford Industrial Realty Inc (NYSE:REXR). This group of stocks’ market valuations resemble CFX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LHCG | 23 | 109472 | -4 |

| SATS | 29 | 410078 | -5 |

| SBRA | 9 | 40738 | -6 |

| REXR | 21 | 263571 | 3 |

| Average | 20.5 | 205965 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.5 hedge funds with bullish positions and the average amount invested in these stocks was $206 million. That figure was $668 million in CFX’s case. Echostar Corporation (NASDAQ:SATS) is the most popular stock in this table. On the other hand Sabra Health Care REIT Inc (NASDAQ:SBRA) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Colfax Corporation (NYSE:CFX) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately CFX wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CFX were disappointed as the stock returned -13% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.