How do you pick the next stock to invest in? One way would be to spend hours of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding Cohu, Inc. (NASDAQ:COHU).

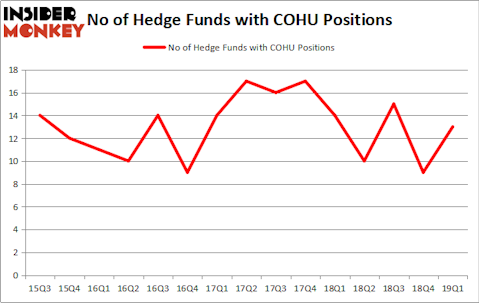

Cohu, Inc. (NASDAQ:COHU) was in 13 hedge funds’ portfolios at the end of the first quarter of 2019. COHU has seen an increase in activity from the world’s largest hedge funds recently. There were 9 hedge funds in our database with COHU holdings at the end of the previous quarter. Our calculations also showed that COHU isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a gander at the recent hedge fund action regarding Cohu, Inc. (NASDAQ:COHU).

What does smart money think about Cohu, Inc. (NASDAQ:COHU)?

At the end of the first quarter, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 44% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in COHU over the last 15 quarters. With hedgies’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

Among these funds, Royce & Associates held the most valuable stake in Cohu, Inc. (NASDAQ:COHU), which was worth $14.7 million at the end of the first quarter. On the second spot was Renaissance Technologies which amassed $10.2 million worth of shares. Moreover, D E Shaw, AlphaOne Capital Partners, and Two Sigma Advisors were also bullish on Cohu, Inc. (NASDAQ:COHU), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, key hedge funds have been driving this bullishness. AlphaOne Capital Partners, managed by Paul Hondros, established the most valuable position in Cohu, Inc. (NASDAQ:COHU). AlphaOne Capital Partners had $1.8 million invested in the company at the end of the quarter. Eric Singer’s VIEX Capital Advisors also made a $1.5 million investment in the stock during the quarter. The other funds with brand new COHU positions are Ken Griffin’s Citadel Investment Group, Cliff Asness’s AQR Capital Management, and Benjamin A. Smith’s Laurion Capital Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Cohu, Inc. (NASDAQ:COHU) but similarly valued. These stocks are Venator Materials PLC (NYSE:VNTR), Tristate Capital Holdings Inc (NASDAQ:TSC), ProQR Therapeutics NV (NASDAQ:PRQR), and Vivint Solar Inc (NYSE:VSLR). This group of stocks’ market valuations are similar to COHU’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VNTR | 18 | 108111 | 2 |

| TSC | 13 | 53936 | -1 |

| PRQR | 10 | 106417 | -1 |

| VSLR | 11 | 23343 | -5 |

| Average | 13 | 72952 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13 hedge funds with bullish positions and the average amount invested in these stocks was $73 million. That figure was $39 million in COHU’s case. Venator Materials PLC (NYSE:VNTR) is the most popular stock in this table. On the other hand ProQR Therapeutics NV (NASDAQ:PRQR) is the least popular one with only 10 bullish hedge fund positions. Cohu, Inc. (NASDAQ:COHU) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on COHU as the stock returned 7.4% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.