Is CNO Financial Group Inc (NYSE:CNO) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to find the winners in the stock market.

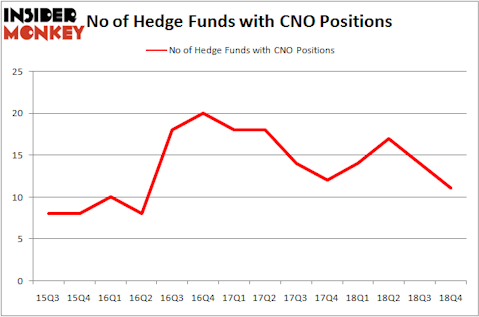

Is CNO Financial Group Inc (NYSE:CNO) a bargain? The best stock pickers are taking a pessimistic view. The number of long hedge fund positions fell by 3 recently. Our calculations also showed that CNO isn’t among the 30 most popular stocks among hedge funds.

According to most stock holders, hedge funds are seen as unimportant, old investment tools of the past. While there are greater than 8000 funds with their doors open today, We hone in on the bigwigs of this club, about 750 funds. These money managers handle most of the hedge fund industry’s total capital, and by following their highest performing equity investments, Insider Monkey has discovered numerous investment strategies that have historically outstripped the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by nearly 5 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s go over the fresh hedge fund action encompassing CNO Financial Group Inc (NYSE:CNO).

How are hedge funds trading CNO Financial Group Inc (NYSE:CNO)?

Heading into the first quarter of 2019, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -21% from the previous quarter. By comparison, 14 hedge funds held shares or bullish call options in CNO a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Huber Capital Management was the largest shareholder of CNO Financial Group Inc (NYSE:CNO), with a stake worth $26.9 million reported as of the end of September. Trailing Huber Capital Management was Millennium Management, which amassed a stake valued at $18.3 million. Renaissance Technologies, GLG Partners, and AQR Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as CNO Financial Group Inc (NYSE:CNO) has faced declining sentiment from the smart money, logic holds that there lies a certain “tier” of hedgies that slashed their entire stakes in the third quarter. It’s worth mentioning that Michael Platt and William Reeves’s BlueCrest Capital Mgmt. sold off the largest stake of all the hedgies tracked by Insider Monkey, valued at an estimated $0.5 million in stock, and Matthew Tewksbury’s Stevens Capital Management was right behind this move, as the fund dumped about $0.4 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest dropped by 3 funds in the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as CNO Financial Group Inc (NYSE:CNO) but similarly valued. We will take a look at Colfax Corporation (NYSE:CFX), Omnicell, Inc. (NASDAQ:OMCL), Box, Inc. (NYSE:BOX), and Houlihan Lokey Inc (NYSE:HLI). All of these stocks’ market caps resemble CNO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CFX | 27 | 333618 | 7 |

| OMCL | 13 | 64252 | 8 |

| BOX | 24 | 386086 | -2 |

| HLI | 18 | 138227 | 4 |

| Average | 20.5 | 230546 | 4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.5 hedge funds with bullish positions and the average amount invested in these stocks was $231 million. That figure was $105 million in CNO’s case. Colfax Corporation (NYSE:CFX) is the most popular stock in this table. On the other hand Omnicell, Inc. (NASDAQ:OMCL) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks CNO Financial Group Inc (NYSE:CNO) is even less popular than OMCL. Hedge funds dodged a bullet by taking a bearish stance towards CNO. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately CNO wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); CNO investors were disappointed as the stock returned 13.5% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.