With the first-quarter round of 13F filings behind us it is time to take a look at the stocks in which some of the best money managers in the world preferred to invest or sell heading into the second quarter. One of these stocks was Cna Financial Corporation (NYSE:CNA).

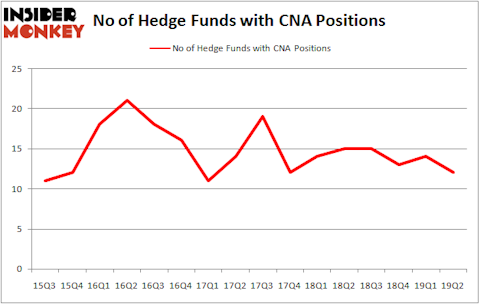

Cna Financial Corporation (NYSE:CNA) shareholders have witnessed a decrease in hedge fund sentiment lately. CNA was in 12 hedge funds’ portfolios at the end of June. There were 14 hedge funds in our database with CNA holdings at the end of the previous quarter. Our calculations also showed that CNA isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To most stock holders, hedge funds are seen as worthless, outdated investment vehicles of years past. While there are over 8000 funds trading today, We look at the crème de la crème of this group, approximately 750 funds. These investment experts command most of the smart money’s total capital, and by keeping track of their top equity investments, Insider Monkey has come up with various investment strategies that have historically outrun the market. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by around 5 percentage points per year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a gander at the key hedge fund action encompassing Cna Financial Corporation (NYSE:CNA).

What have hedge funds been doing with Cna Financial Corporation (NYSE:CNA)?

At Q2’s end, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -14% from one quarter earlier. By comparison, 15 hedge funds held shares or bullish call options in CNA a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

The largest stake in Cna Financial Corporation (NYSE:CNA) was held by Renaissance Technologies, which reported holding $47.4 million worth of stock at the end of March. It was followed by GLG Partners with a $12.8 million position. Other investors bullish on the company included Millennium Management, AQR Capital Management, and Levin Capital Strategies.

Since Cna Financial Corporation (NYSE:CNA) has witnessed bearish sentiment from hedge fund managers, it’s safe to say that there lies a certain “tier” of fund managers that elected to cut their full holdings in the second quarter. At the top of the heap, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital said goodbye to the largest position of all the hedgies watched by Insider Monkey, valued at an estimated $3.7 million in stock, and Dmitry Balyasny’s Balyasny Asset Management was right behind this move, as the fund dumped about $0.5 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest dropped by 2 funds in the second quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Cna Financial Corporation (NYSE:CNA) but similarly valued. These stocks are UDR, Inc. (NYSE:UDR), Expeditors International of Washington, Inc. (NASDAQ:EXPD), Steris Plc (NYSE:STE), and Teck Resources Ltd (NYSE:TECK). This group of stocks’ market values are closest to CNA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UDR | 16 | 645705 | -2 |

| EXPD | 25 | 398382 | -5 |

| STE | 22 | 287399 | 1 |

| TECK | 23 | 915558 | -4 |

| Average | 21.5 | 561761 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.5 hedge funds with bullish positions and the average amount invested in these stocks was $562 million. That figure was $88 million in CNA’s case. Expeditors International of Washington, Inc. (NASDAQ:EXPD) is the most popular stock in this table. On the other hand UDR, Inc. (NYSE:UDR) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks Cna Financial Corporation (NYSE:CNA) is even less popular than UDR. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on CNA, though not to the same extent, as the stock returned 5.4% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.