During the fourth quarter the Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by nearly 7 percentage points as investors worried over the possible ramifications of rising interest rates. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Cinemark Holdings, Inc. (NYSE:CNK) and see how the stock is affected by the recent hedge fund activity.

Is Cinemark Holdings, Inc. (NYSE:CNK) an exceptional investment now? Investors who are in the know are becoming less confident. The number of long hedge fund positions went down by 2 lately. Our calculations also showed that CNK isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a peek at the latest hedge fund action encompassing Cinemark Holdings, Inc. (NYSE:CNK).

What have hedge funds been doing with Cinemark Holdings, Inc. (NYSE:CNK)?

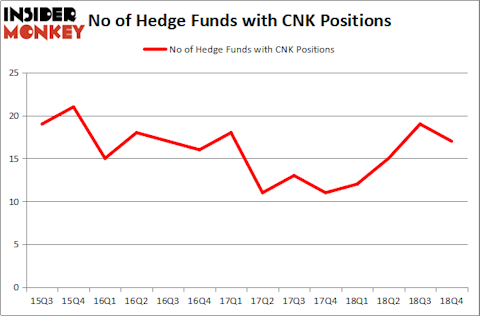

At Q4’s end, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -11% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards CNK over the last 14 quarters. With the smart money’s capital changing hands, there exists a select group of notable hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

Among these funds, Rivulet Capital held the most valuable stake in Cinemark Holdings, Inc. (NYSE:CNK), which was worth $66.6 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $47.2 million worth of shares. Moreover, Maverick Capital, Millennium Management, and Two Sigma Advisors were also bullish on Cinemark Holdings, Inc. (NYSE:CNK), allocating a large percentage of their portfolios to this stock.

Seeing as Cinemark Holdings, Inc. (NYSE:CNK) has experienced a decline in interest from the aggregate hedge fund industry, logic holds that there exists a select few fund managers that decided to sell off their entire stakes heading into Q3. Interestingly, Dmitry Balyasny’s Balyasny Asset Management said goodbye to the biggest position of all the hedgies followed by Insider Monkey, worth close to $9.9 million in stock, and Paul Tudor Jones’s Tudor Investment Corp was right behind this move, as the fund dumped about $1.8 million worth. These moves are important to note, as total hedge fund interest dropped by 2 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Cinemark Holdings, Inc. (NYSE:CNK) but similarly valued. These stocks are ONE Gas Inc (NYSE:OGS), Western Alliance Bancorporation (NYSE:WAL), Bemis Company, Inc. (NYSE:BMS), and LogMeIn Inc (NASDAQ:LOGM). This group of stocks’ market caps resemble CNK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OGS | 17 | 80042 | 2 |

| WAL | 28 | 353911 | 5 |

| BMS | 26 | 304544 | 0 |

| LOGM | 28 | 560052 | -1 |

| Average | 24.75 | 324637 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.75 hedge funds with bullish positions and the average amount invested in these stocks was $325 million. That figure was $166 million in CNK’s case. Western Alliance Bancorporation (NYSE:WAL) is the most popular stock in this table. On the other hand ONE Gas Inc (NYSE:OGS) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks Cinemark Holdings, Inc. (NYSE:CNK) is even less popular than OGS. Hedge funds dodged a bullet by taking a bearish stance towards CNK. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately CNK wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); CNK investors were disappointed as the stock returned 15.1% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.