After several tireless days we have finished crunching the numbers from nearly 750 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of December 31. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Churchill Downs Incorporated (NASDAQ:CHDN).

Hedge fund interest in Churchill Downs Incorporated (NASDAQ:CHDN) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare CHDN to other stocks including Eastgroup Properties Inc (NYSE:EGP), Schneider National, Inc. (NYSE:SNDR), and Taro Pharmaceutical Industries Ltd. (NYSE:TARO) to get a better sense of its popularity.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to take a gander at the fresh hedge fund action regarding Churchill Downs Incorporated (NASDAQ:CHDN).

What does the smart money think about Churchill Downs Incorporated (NASDAQ:CHDN)?

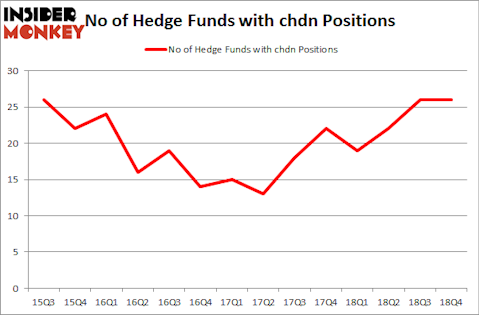

At Q4’s end, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the second quarter of 2018. By comparison, 19 hedge funds held shares or bullish call options in CHDN a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

Among these funds, PAR Capital Management held the most valuable stake in Churchill Downs Incorporated (NASDAQ:CHDN), which was worth $166.1 million at the end of the third quarter. On the second spot was Balyasny Asset Management which amassed $66.7 million worth of shares. Moreover, Citadel Investment Group, GAMCO Investors, and Hudson Way Capital Management were also bullish on Churchill Downs Incorporated (NASDAQ:CHDN), allocating a large percentage of their portfolios to this stock.

Judging by the fact that Churchill Downs Incorporated (NASDAQ:CHDN) has experienced declining sentiment from the smart money, logic holds that there is a sect of fund managers that decided to sell off their full holdings in the third quarter. Interestingly, Israel Englander’s Millennium Management sold off the biggest investment of the “upper crust” of funds watched by Insider Monkey, worth close to $2.5 million in stock, and Joel Greenblatt’s Gotham Asset Management was right behind this move, as the fund dumped about $2.2 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to Churchill Downs Incorporated (NASDAQ:CHDN). These stocks are Eastgroup Properties Inc (NYSE:EGP), Schneider National, Inc. (NYSE:SNDR), Taro Pharmaceutical Industries Ltd. (NYSE:TARO), and Graphic Packaging Holding Company (NYSE:GPK). This group of stocks’ market values are similar to CHDN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EGP | 7 | 25033 | 2 |

| SNDR | 20 | 92694 | 1 |

| TARO | 8 | 61336 | -6 |

| GPK | 20 | 636989 | -5 |

| Average | 13.75 | 204013 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.75 hedge funds with bullish positions and the average amount invested in these stocks was $204 million. That figure was $476 million in CHDN’s case. Schneider National, Inc. (NYSE:SNDR) is the most popular stock in this table. On the other hand Eastgroup Properties Inc (NYSE:EGP) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Churchill Downs Incorporated (NASDAQ:CHDN) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately CHDN wasn’t nearly as popular as these 15 stock and hedge funds that were betting on CHDN were disappointed as the stock returned 11.2% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.