Hedge funds are known to underperform the bull markets but that’s not because they are terrible at stock picking. Hedge funds underperform because their net exposure in only 40-70% and they charge exorbitant fees. No one knows what the future holds and how market participants will react to the bountiful news that floods in each day. However, hedge funds’ consensus picks on average deliver market beating returns. For example in the first 5 months of this year through May 30th the Standard and Poor’s 500 Index returned approximately 12.1% (including dividend payments). Conversely, hedge funds’ top 20 large-cap stock picks generated a return of 18.7% during the same 5-month period, with the majority of these stock picks outperforming the broader market benchmark. Interestingly, an average long/short hedge fund returned only a fraction of this value due to the hedges they implemented and the large fees they charged. If you pay attention to the actual hedge fund returns versus the returns of their long stock picks, you might believe that it is a waste of time to analyze hedge funds’ purchases. We know better. That’s why we scrutinize hedge fund sentiment before we invest in a stock like Chipotle Mexican Grill, Inc. (NYSE:CMG).

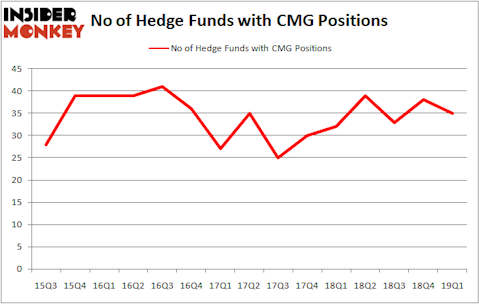

Chipotle Mexican Grill, Inc. (NYSE:CMG) shareholders have witnessed a decrease in hedge fund interest of late. Our calculations also showed that CMG isn’t among the 30 most popular stocks among hedge funds.

According to most traders, hedge funds are seen as worthless, old financial tools of yesteryear. While there are greater than 8000 funds trading today, Our researchers choose to focus on the moguls of this group, approximately 750 funds. It is estimated that this group of investors have their hands on the lion’s share of all hedge funds’ total capital, and by following their matchless stock picks, Insider Monkey has unsheathed various investment strategies that have historically defeated Mr. Market. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by around 5 percentage points per year since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

We’re going to take a gander at the key hedge fund action surrounding Chipotle Mexican Grill, Inc. (NYSE:CMG).

How are hedge funds trading Chipotle Mexican Grill, Inc. (NYSE:CMG)?

At Q1’s end, a total of 35 of the hedge funds tracked by Insider Monkey were long this stock, a change of -8% from the fourth quarter of 2018. By comparison, 32 hedge funds held shares or bullish call options in CMG a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

More specifically, Pershing Square was the largest shareholder of Chipotle Mexican Grill, Inc. (NYSE:CMG), with a stake worth $1323.1 million reported as of the end of March. Trailing Pershing Square was Renaissance Technologies, which amassed a stake valued at $1037.3 million. Citadel Investment Group, Two Sigma Advisors, and D E Shaw were also very fond of the stock, giving the stock large weights in their portfolios.

Because Chipotle Mexican Grill, Inc. (NYSE:CMG) has experienced a decline in interest from the aggregate hedge fund industry, logic holds that there exists a select few hedge funds who were dropping their entire stakes by the end of the third quarter. It’s worth mentioning that David Blood and Al Gore’s Generation Investment Management sold off the largest investment of all the hedgies monitored by Insider Monkey, valued at close to $79.7 million in stock, and David Harding’s Winton Capital Management was right behind this move, as the fund cut about $15.9 million worth. These bearish behaviors are interesting, as total hedge fund interest dropped by 3 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks similar to Chipotle Mexican Grill, Inc. (NYSE:CMG). These stocks are The Kroger Co. (NYSE:KR), KKR & Co Inc. (NYSE:KKR), Discovery Inc. (NASDAQ:DISCA), and Discovery Inc. (NASDAQ:DISCK). This group of stocks’ market values resemble CMG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KR | 22 | 504839 | -11 |

| KKR | 30 | 2526675 | 1 |

| DISCA | 26 | 373215 | 2 |

| DISCK | 26 | 655739 | -8 |

| Average | 26 | 1015117 | -4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26 hedge funds with bullish positions and the average amount invested in these stocks was $1015 million. That figure was $3507 million in CMG’s case. KKR & Co Inc. (NYSE:KKR) is the most popular stock in this table. On the other hand The Kroger Co. (NYSE:KR) is the least popular one with only 22 bullish hedge fund positions. Compared to these stocks Chipotle Mexican Grill, Inc. (NYSE:CMG) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately CMG wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CMG were disappointed as the stock returned -4.5% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.