Hedge funds run by legendary names like George Soros and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant outperformance. That’s why we pay special attention to hedge fund activity in these stocks.

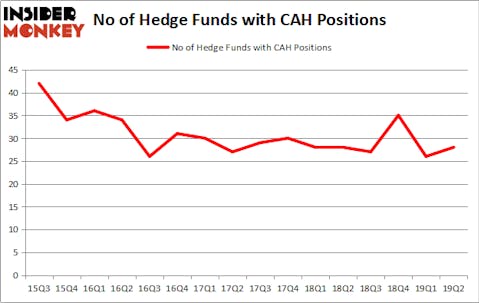

Cardinal Health, Inc. (NYSE:CAH) has seen an increase in enthusiasm from smart money in recent months. CAH was in 28 hedge funds’ portfolios at the end of the second quarter of 2019. There were 26 hedge funds in our database with CAH holdings at the end of the previous quarter. Our calculations also showed that CAH isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most shareholders, hedge funds are assumed to be slow, outdated financial vehicles of yesteryear. While there are over 8000 funds trading today, Our researchers look at the moguls of this group, about 750 funds. These investment experts command the lion’s share of the hedge fund industry’s total capital, and by keeping track of their matchless stock picks, Insider Monkey has discovered a number of investment strategies that have historically beaten the broader indices. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by around 5 percentage points per year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to check out the new hedge fund action surrounding Cardinal Health, Inc. (NYSE:CAH).

Hedge fund activity in Cardinal Health, Inc. (NYSE:CAH)

At the end of the second quarter, a total of 28 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 8% from the previous quarter. On the other hand, there were a total of 28 hedge funds with a bullish position in CAH a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Pzena Investment Management was the largest shareholder of Cardinal Health, Inc. (NYSE:CAH), with a stake worth $171.7 million reported as of the end of March. Trailing Pzena Investment Management was D E Shaw, which amassed a stake valued at $101.3 million. Renaissance Technologies, AQR Capital Management, and Two Sigma Advisors were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, key hedge funds were breaking ground themselves. Scion Asset Management, managed by Michael Burry, assembled the largest position in Cardinal Health, Inc. (NYSE:CAH). Scion Asset Management had $9.4 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also made a $6.4 million investment in the stock during the quarter. The following funds were also among the new CAH investors: Matthew Tewksbury’s Stevens Capital Management, Anthony Scaramucci’s Skybridge Capital, and Dmitry Balyasny’s Balyasny Asset Management.

Let’s also examine hedge fund activity in other stocks similar to Cardinal Health, Inc. (NYSE:CAH). These stocks are Korea Electric Power Corporation (NYSE:KEP), CrowdStrike Holdings, Inc. (NASDAQ:CRWD), Skyworks Solutions Inc (NASDAQ:SWKS), and Brookfield Property REIT Inc. (NASDAQ:BPR). This group of stocks’ market valuations are similar to CAH’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KEP | 7 | 43572 | -3 |

| CRWD | 41 | 343926 | 41 |

| SWKS | 31 | 734317 | -7 |

| BPR | 16 | 62007 | 1 |

| Average | 23.75 | 295956 | 8 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.75 hedge funds with bullish positions and the average amount invested in these stocks was $296 million. That figure was $765 million in CAH’s case. CrowdStrike Holdings, Inc. (NASDAQ:CRWD) is the most popular stock in this table. On the other hand Korea Electric Power Corporation (NYSE:KEP) is the least popular one with only 7 bullish hedge fund positions. Cardinal Health, Inc. (NYSE:CAH) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately CAH wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CAH were disappointed as the stock returned 1.2% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.