Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we pay special attention to the hedge fund activity in the small-cap space.

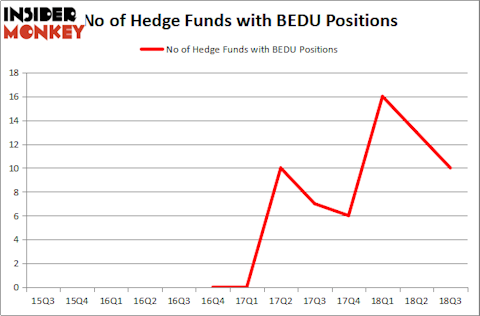

Bright Scholar Education Holdings Limited (NYSE:BEDU) has experienced a decrease in support from the world’s most elite money managers of late. Our calculations also showed that BEDU isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are a large number of gauges investors can use to grade stocks. Two of the most underrated gauges are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the top picks of the elite hedge fund managers can outpace the S&P 500 by a very impressive amount (see the details here).

Let’s view the key hedge fund action encompassing Bright Scholar Education Holdings Limited (NYSE:BEDU).

What have hedge funds been doing with Bright Scholar Education Holdings Limited (NYSE:BEDU)?

At Q4’s end, a total of 8 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -20% from one quarter earlier. On the other hand, there were a total of 16 hedge funds with a bullish position in BEDU a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Serenity Capital was the largest shareholder of Bright Scholar Education Holdings Limited (NYSE:BEDU), with a stake worth $46.7 million reported as of the end of December. Trailing Serenity Capital was Indus Capital, which amassed a stake valued at $36.5 million. Marshall Wace LLP, Millennium Management, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that Bright Scholar Education Holdings Limited (NYSE:BEDU) has faced a decline in interest from the aggregate hedge fund industry, it’s safe to say that there lies a certain “tier” of funds that slashed their full holdings by the end of the third quarter. At the top of the heap, Lei Zhang’s Hillhouse Capital Management said goodbye to the largest stake of the “upper crust” of funds tracked by Insider Monkey, worth about $49.4 million in stock. Chase Coleman’s fund, Tiger Global Management LLC, also dropped its stock, about $25 million worth. These moves are important to note, as aggregate hedge fund interest fell by 2 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Bright Scholar Education Holdings Limited (NYSE:BEDU) but similarly valued. These stocks are SRC Energy Inc. (NYSE:SRCI), BrightSphere Investment Group plc (NYSE:BSIG), Monmouth R.E. Inv. Corp. (NYSE:MNR), and Gulfport Energy Corporation (NASDAQ:GPOR). This group of stocks’ market values are similar to BEDU’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SRCI | 14 | 274876 | -1 |

| BSIG | 22 | 137597 | 0 |

| MNR | 9 | 63337 | 1 |

| GPOR | 22 | 129057 | 2 |

| Average | 16.75 | 151217 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $151 million. That figure was $90 million in BEDU’s case. BrightSphere Investment Group plc (NYSE:BSIG) is the most popular stock in this table. On the other hand Monmouth R.E. Inv. Corp. (NYSE:MNR) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Bright Scholar Education Holdings Limited (NYSE:BEDU) is even less popular than MNR. Hedge funds clearly dropped the ball on BEDU as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on BEDU as the stock returned 26.1% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.