Hedge funds are known to underperform the bull markets but that’s not because they are bad at investing. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. Hedge funds underperform because they are hedged. The Standard and Poor’s 500 Index returned approximately 12.1% in the first 5 months of this year through May 30th (including dividend payments). Conversely, hedge funds’ top 20 large-cap stock picks generated a return of 18.7% during the same 5-month period. An average long/short hedge fund returned only a fraction of this due to the hedges they implement and the large fees they charge. Our research covering the last 18 years indicates that investors can outperform the market by imitating hedge funds’ stock picks rather than directly investing in hedge funds. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Avis Budget Group Inc. (NASDAQ:CAR).

Avis Budget Group Inc. (NASDAQ:CAR) shareholders have witnessed a decrease in enthusiasm from smart money lately. Our calculations also showed that CAR isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to take a look at the new hedge fund action regarding Avis Budget Group Inc. (NASDAQ:CAR).

How have hedgies been trading Avis Budget Group Inc. (NASDAQ:CAR)?

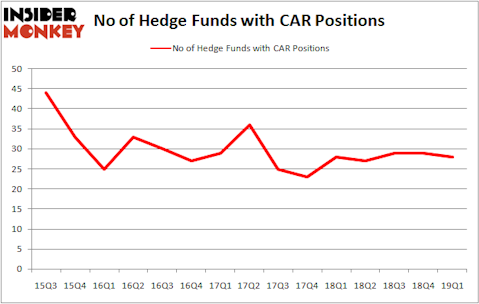

Heading into the second quarter of 2019, a total of 28 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -3% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards CAR over the last 15 quarters. With hedge funds’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

More specifically, SRS Investment Management was the largest shareholder of Avis Budget Group Inc. (NASDAQ:CAR), with a stake worth $564.4 million reported as of the end of March. Trailing SRS Investment Management was Glenview Capital, which amassed a stake valued at $125.2 million. Pzena Investment Management, Renaissance Technologies, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that Avis Budget Group Inc. (NASDAQ:CAR) has witnessed bearish sentiment from the aggregate hedge fund industry, logic holds that there lies a certain “tier” of fund managers who were dropping their entire stakes last quarter. It’s worth mentioning that Phill Gross and Robert Atchinson’s Adage Capital Management dropped the biggest investment of all the hedgies monitored by Insider Monkey, comprising about $9.3 million in stock. Wayne Cooperman’s fund, Cobalt Capital Management, also sold off its stock, about $4.5 million worth. These transactions are important to note, as total hedge fund interest was cut by 1 funds last quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Avis Budget Group Inc. (NASDAQ:CAR) but similarly valued. These stocks are Stantec Inc. (NYSE:STN), Barnes Group Inc. (NYSE:B), Rexnord Corp (NYSE:RXN), and Columbia Property Trust Inc (NYSE:CXP). All of these stocks’ market caps are similar to CAR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| STN | 5 | 68587 | 1 |

| B | 18 | 43588 | 4 |

| RXN | 21 | 171232 | 2 |

| CXP | 15 | 83003 | 2 |

| Average | 14.75 | 91603 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.75 hedge funds with bullish positions and the average amount invested in these stocks was $92 million. That figure was $1064 million in CAR’s case. Rexnord Corp (NYSE:RXN) is the most popular stock in this table. On the other hand Stantec Inc. (NYSE:STN) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Avis Budget Group Inc. (NASDAQ:CAR) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately CAR wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CAR were disappointed as the stock returned -17.4% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.