Is Arrowhead Pharmaceuticals, Inc. (NASDAQ:ARWR) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before doing days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

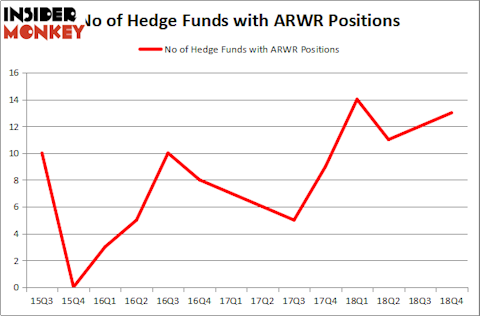

Arrowhead Pharmaceuticals, Inc. (NASDAQ:ARWR) has seen an increase in enthusiasm from smart money of late. Our calculations also showed that ARWR isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s take a gander at the key hedge fund action regarding Arrowhead Pharmaceuticals, Inc. (NASDAQ:ARWR).

How have hedgies been trading Arrowhead Pharmaceuticals, Inc. (NASDAQ:ARWR)?

At the end of the fourth quarter, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 8% from the previous quarter. By comparison, 14 hedge funds held shares or bullish call options in ARWR a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Vivo Capital held the most valuable stake in Arrowhead Pharmaceuticals, Inc. (NASDAQ:ARWR), which was worth $28.9 million at the end of the fourth quarter. On the second spot was Farallon Capital which amassed $18.6 million worth of shares. Moreover, Adage Capital Management, Aquilo Capital Management, and Perceptive Advisors were also bullish on Arrowhead Pharmaceuticals, Inc. (NASDAQ:ARWR), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, some big names were breaking ground themselves. Vivo Capital, managed by Albert Cha and Frank Kung, initiated the largest position in Arrowhead Pharmaceuticals, Inc. (NASDAQ:ARWR). Vivo Capital had $28.9 million invested in the company at the end of the quarter. Thomas Steyer’s Farallon Capital also initiated a $18.6 million position during the quarter. The other funds with new positions in the stock are Marc Schneidman’s Aquilo Capital Management, Sander Gerber’s Hudson Bay Capital Management, and David Harding’s Winton Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Arrowhead Pharmaceuticals, Inc. (NASDAQ:ARWR) but similarly valued. These stocks are Tahoe Resources Inc (NYSE:TAHO), Noble Midstream Partners LP (NYSE:NBLX), Freshpet Inc (NASDAQ:FRPT), and ATN International, Inc. (NASDAQ:ATNI). All of these stocks’ market caps are closest to ARWR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TAHO | 17 | 62923 | 4 |

| NBLX | 6 | 17570 | 0 |

| FRPT | 21 | 57688 | 8 |

| ATNI | 10 | 73263 | 2 |

| Average | 13.5 | 52861 | 3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $53 million. That figure was $88 million in ARWR’s case. Freshpet Inc (NASDAQ:FRPT) is the most popular stock in this table. On the other hand Noble Midstream Partners LP (NYSE:NBLX) is the least popular one with only 6 bullish hedge fund positions. Arrowhead Pharmaceuticals, Inc. (NASDAQ:ARWR) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on ARWR as the stock returned 49.2% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.