A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended March 31, so let’s proceed with the discussion of the hedge fund sentiment on Anworth Mortgage Asset Corporation (NYSE:ANH).

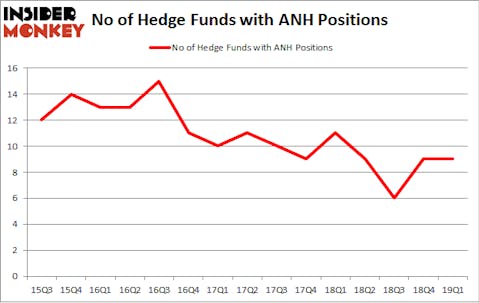

Anworth Mortgage Asset Corporation (NYSE:ANH) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 9 hedge funds’ portfolios at the end of the first quarter of 2019. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as XBiotech Inc. (NASDAQ:XBIT), PAR Technology Corporation (NYSE:PAR), and Barnes & Noble, Inc. (NYSE:BKS) to gather more data points.

At the moment there are plenty of formulas investors put to use to assess stocks. A couple of the best formulas are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the best picks of the elite money managers can outclass the broader indices by a very impressive amount (see the details here).

We’re going to take a look at the recent hedge fund action regarding Anworth Mortgage Asset Corporation (NYSE:ANH).

How are hedge funds trading Anworth Mortgage Asset Corporation (NYSE:ANH)?

At the end of the first quarter, a total of 9 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. On the other hand, there were a total of 11 hedge funds with a bullish position in ANH a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in Anworth Mortgage Asset Corporation (NYSE:ANH), which was worth $27.6 million at the end of the first quarter. On the second spot was Millennium Management which amassed $1.8 million worth of shares. Moreover, Blue Mountain Capital, Almitas Capital, and Caxton Associates LP were also bullish on Anworth Mortgage Asset Corporation (NYSE:ANH), allocating a large percentage of their portfolios to this stock.

Seeing as Anworth Mortgage Asset Corporation (NYSE:ANH) has experienced declining sentiment from the smart money, it’s safe to say that there was a specific group of money managers who sold off their entire stakes heading into Q3. Intriguingly, Michael Platt and William Reeves’s BlueCrest Capital Mgmt. sold off the largest investment of all the hedgies watched by Insider Monkey, worth about $0.2 million in stock, and Ken Griffin’s Citadel Investment Group was right behind this move, as the fund dropped about $0.1 million worth. These transactions are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Anworth Mortgage Asset Corporation (NYSE:ANH) but similarly valued. These stocks are XBiotech Inc. (NASDAQ:XBIT), PAR Technology Corporation (NYSE:PAR), Barnes & Noble, Inc. (NYSE:BKS), and Greenlight Capital Re, Ltd. (NASDAQ:GLRE). This group of stocks’ market valuations match ANH’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XBIT | 7 | 7193 | 5 |

| PAR | 6 | 22917 | 2 |

| BKS | 18 | 31372 | 1 |

| GLRE | 3 | 1831 | -2 |

| Average | 8.5 | 15828 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.5 hedge funds with bullish positions and the average amount invested in these stocks was $16 million. That figure was $32 million in ANH’s case. Barnes & Noble, Inc. (NYSE:BKS) is the most popular stock in this table. On the other hand Greenlight Capital Re, Ltd. (NASDAQ:GLRE) is the least popular one with only 3 bullish hedge fund positions. Anworth Mortgage Asset Corporation (NYSE:ANH) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately ANH wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on ANH were disappointed as the stock returned -5.4% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.