Hedge funds are known to underperform the bull markets but that’s not because they are bad at investing. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. Hedge funds underperform because they are hedged. The Standard and Poor’s 500 Index returned approximately 13.1% in the first 2.5 months of this year (including dividend payments). Conversely, hedge funds’ top 15 large-cap stock picks generated a return of 19.7% during the same 2.5-month period, with 93% of these stock picks outperforming the broader market benchmark. An average long/short hedge fund returned only 5% due to the hedges they implement and the large fees they charge. Our research covering the last 18 years indicates that investors can outperform the market by imitating hedge funds’ stock picks rather than directly investing in hedge funds. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Amneal Pharmaceuticals, Inc. (NYSE:AMRX).

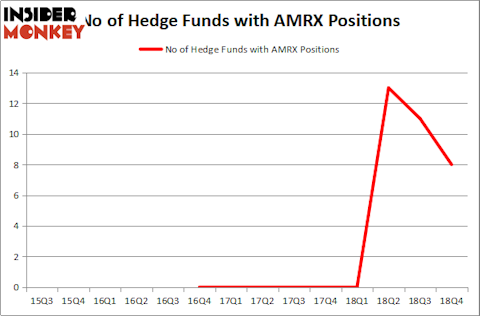

Amneal Pharmaceuticals, Inc. (NYSE:AMRX) was in 8 hedge funds’ portfolios at the end of the fourth quarter of 2018. AMRX investors should pay attention to a decrease in hedge fund interest of late. There were 11 hedge funds in our database with AMRX holdings at the end of the previous quarter. Our calculations also showed that AMRX isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most traders, hedge funds are assumed to be slow, old financial vehicles of the past. While there are greater than 8000 funds in operation at present, We hone in on the elite of this group, about 750 funds. These money managers watch over the majority of the smart money’s total asset base, and by tracking their first-class investments, Insider Monkey has discovered a few investment strategies that have historically exceeded the market. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to take a gander at the latest hedge fund action encompassing Amneal Pharmaceuticals, Inc. (NYSE:AMRX).

What have hedge funds been doing with Amneal Pharmaceuticals, Inc. (NYSE:AMRX)?

At Q4’s end, a total of 8 of the hedge funds tracked by Insider Monkey were long this stock, a change of -27% from the previous quarter. The graph below displays the number of hedge funds with bullish position in AMRX over the last 14 quarters. With the smart money’s sentiment swirling, there exists a few noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

Among these funds, Viking Global held the most valuable stake in Amneal Pharmaceuticals, Inc. (NYSE:AMRX), which was worth $31.8 million at the end of the third quarter. On the second spot was Bridger Management which amassed $13.8 million worth of shares. Moreover, Renaissance Technologies, D E Shaw, and Alyeska Investment Group were also bullish on Amneal Pharmaceuticals, Inc. (NYSE:AMRX), allocating a large percentage of their portfolios to this stock.

Seeing as Amneal Pharmaceuticals, Inc. (NYSE:AMRX) has witnessed falling interest from hedge fund managers, it’s easy to see that there was a specific group of hedgies that slashed their positions entirely by the end of the third quarter. At the top of the heap, Arthur B Cohen and Joseph Healey’s Healthcor Management LP cut the biggest stake of the 700 funds tracked by Insider Monkey, comprising an estimated $23 million in stock, and Steve Cohen’s Point72 Asset Management was right behind this move, as the fund cut about $17.8 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest was cut by 3 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Amneal Pharmaceuticals, Inc. (NYSE:AMRX). These stocks are Kirby Corporation (NYSE:KEX), nVent Electric plc (NYSE:NVT), Brunswick Corporation (NYSE:BC), and Janus Henderson Group plc (NYSE:JHG). This group of stocks’ market caps match AMRX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KEX | 16 | 409084 | 0 |

| NVT | 28 | 1015805 | -1 |

| BC | 26 | 524487 | -8 |

| JHG | 15 | 132302 | -2 |

| Average | 21.25 | 520420 | -2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.25 hedge funds with bullish positions and the average amount invested in these stocks was $520 million. That figure was $76 million in AMRX’s case. nVent Electric plc (NYSE:NVT) is the most popular stock in this table. On the other hand Janus Henderson Group plc (NYSE:JHG) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Amneal Pharmaceuticals, Inc. (NYSE:AMRX) is even less popular than JHG. Hedge funds dodged a bullet by taking a bearish stance towards AMRX. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately AMRX wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); AMRX investors were disappointed as the stock returned -5.2% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.