World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

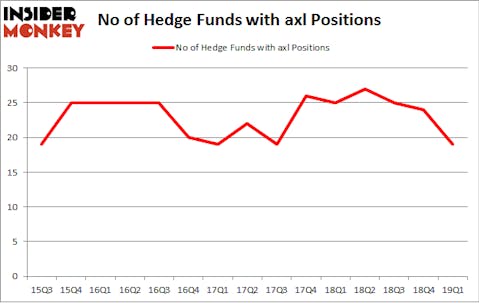

American Axle & Manufacturing Holdings, Inc. (NYSE:AXL) was in 19 hedge funds’ portfolios at the end of March. AXL investors should be aware of a decrease in activity from the world’s largest hedge funds in recent months. There were 24 hedge funds in our database with AXL positions at the end of the previous quarter. Our calculations also showed that axl isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a look at the latest hedge fund action surrounding American Axle & Manufacturing Holdings, Inc. (NYSE:AXL).

How are hedge funds trading American Axle & Manufacturing Holdings, Inc. (NYSE:AXL)?

At the end of the first quarter, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -21% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards AXL over the last 15 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in American Axle & Manufacturing Holdings, Inc. (NYSE:AXL) was held by Anchor Bolt Capital, which reported holding $31.4 million worth of stock at the end of March. It was followed by Arrowstreet Capital with a $24 million position. Other investors bullish on the company included Redwood Capital Management, Citadel Investment Group, and Scopus Asset Management.

Due to the fact that American Axle & Manufacturing Holdings, Inc. (NYSE:AXL) has faced falling interest from the smart money, it’s easy to see that there is a sect of funds that elected to cut their positions entirely heading into Q3. It’s worth mentioning that Robert Polak’s Anchor Bolt Capital cut the biggest investment of all the hedgies watched by Insider Monkey, totaling about $7.1 million in stock. Noam Gottesman’s fund, GLG Partners, also dropped its stock, about $4.4 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest fell by 5 funds heading into Q3.

Let’s go over hedge fund activity in other stocks similar to American Axle & Manufacturing Holdings, Inc. (NYSE:AXL). We will take a look at Virtusa Corporation (NASDAQ:VRTU), B&G Foods, Inc. (NYSE:BGS), PROS Holdings, Inc. (NYSE:PRO), and TIER REIT, Inc. (NYSE:TIER). This group of stocks’ market caps resemble AXL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VRTU | 10 | 63089 | -4 |

| BGS | 19 | 195714 | 9 |

| PRO | 19 | 159084 | 4 |

| TIER | 12 | 127254 | 5 |

| Average | 15 | 136285 | 3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $136 million. That figure was $126 million in AXL’s case. B&G Foods, Inc. (NYSE:BGS) is the most popular stock in this table. On the other hand Virtusa Corporation (NASDAQ:VRTU) is the least popular one with only 10 bullish hedge fund positions. American Axle & Manufacturing Holdings, Inc. (NYSE:AXL) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately AXL wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on AXL were disappointed as the stock returned -25.5% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.