Does Alkermes Plc (NASDAQ:ALKS) represent a good buying opportunity at the moment? Let’s briefly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on satellite photos and other research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but net net their stock picks have been generating superior risk-adjusted returns on average over the years.

Alkermes Plc (NASDAQ:ALKS) has experienced an increase in support from the world’s most elite money managers of late. Our calculations also showed that ALKS isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to take a gander at the new hedge fund action surrounding Alkermes Plc (NASDAQ:ALKS).

What have hedge funds been doing with Alkermes Plc (NASDAQ:ALKS)?

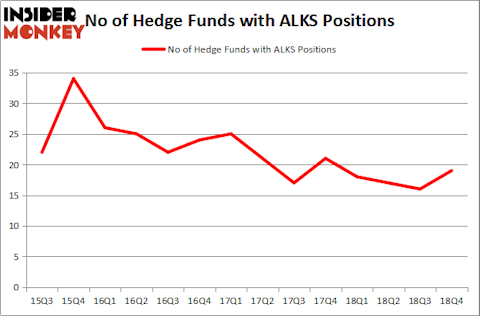

At the end of the fourth quarter, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 19% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in ALKS over the last 14 quarters. With the smart money’s capital changing hands, there exists a few notable hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Woodford Investment Management, managed by Neil Woodford, holds the number one position in Alkermes Plc (NASDAQ:ALKS). Woodford Investment Management has a $77.9 million position in the stock, comprising 6.7% of its 13F portfolio. Coming in second is Millennium Management, managed by Israel Englander, which holds a $27.2 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Remaining professional money managers that hold long positions comprise Jim Simons’s Renaissance Technologies, Steve Cohen’s Point72 Asset Management and Ken Griffin’s Citadel Investment Group.

Consequently, some big names have jumped into Alkermes Plc (NASDAQ:ALKS) headfirst. Renaissance Technologies, managed by Jim Simons, established the largest position in Alkermes Plc (NASDAQ:ALKS). Renaissance Technologies had $23.4 million invested in the company at the end of the quarter. Steve Cohen’s Point72 Asset Management also made a $10.9 million investment in the stock during the quarter. The other funds with new positions in the stock are Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s now review hedge fund activity in other stocks similar to Alkermes Plc (NASDAQ:ALKS). We will take a look at Proofpoint Inc (NASDAQ:PFPT), Hudson Pacific Properties Inc (NYSE:HPP), Banco de Chile (NYSE:BCH), and Caesars Entertainment Corp (NASDAQ:CZR). All of these stocks’ market caps match ALKS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PFPT | 27 | 501166 | 2 |

| HPP | 12 | 361481 | -1 |

| BCH | 4 | 74330 | 2 |

| CZR | 58 | 2224442 | -4 |

| Average | 25.25 | 790355 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.25 hedge funds with bullish positions and the average amount invested in these stocks was $790 million. That figure was $175 million in ALKS’s case. Caesars Entertainment Corp (NASDAQ:CZR) is the most popular stock in this table. On the other hand Banco de Chile (NYSE:BCH) is the least popular one with only 4 bullish hedge fund positions. Alkermes Plc (NASDAQ:ALKS) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately ALKS wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); ALKS investors were disappointed as the stock returned 14.1% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.