The elite funds run by legendary investors such as David Tepper and Dan Loeb make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentives to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at Alexandria Real Estate Equities Inc (NYSE:ARE) from the perspective of those elite funds.

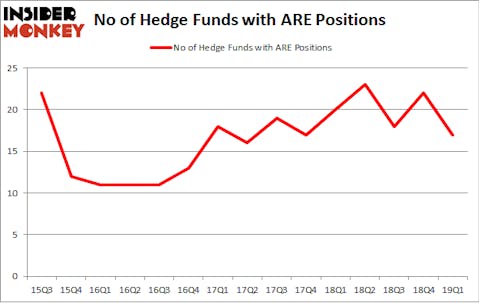

Alexandria Real Estate Equities Inc (NYSE:ARE) has seen a decrease in activity from the world’s largest hedge funds recently. Our calculations also showed that ARE isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s review the fresh hedge fund action regarding Alexandria Real Estate Equities Inc (NYSE:ARE).

What does smart money think about Alexandria Real Estate Equities Inc (NYSE:ARE)?

Heading into the second quarter of 2019, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -23% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards ARE over the last 15 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Alexandria Real Estate Equities Inc (NYSE:ARE) was held by Millennium Management, which reported holding $50.2 million worth of stock at the end of March. It was followed by Capital Growth Management with a $44.2 million position. Other investors bullish on the company included Echo Street Capital Management, Winton Capital Management, and Adage Capital Management.

Judging by the fact that Alexandria Real Estate Equities Inc (NYSE:ARE) has witnessed falling interest from hedge fund managers, logic holds that there is a sect of hedgies that elected to cut their entire stakes heading into Q3. Interestingly, Clint Carlson’s Carlson Capital dropped the biggest investment of the 700 funds tracked by Insider Monkey, totaling an estimated $16.3 million in stock, and Andrew Weiss’s Weiss Asset Management was right behind this move, as the fund sold off about $6.7 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest fell by 5 funds heading into Q3.

Let’s go over hedge fund activity in other stocks similar to Alexandria Real Estate Equities Inc (NYSE:ARE). These stocks are SS&C Technologies Holdings, Inc. (NASDAQ:SSNC), Suzano S.A. (NYSE:SUZ), Twilio Inc. (NYSE:TWLO), and Fortis Inc. (NYSE:FTS). This group of stocks’ market values are similar to ARE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SSNC | 37 | 1718479 | 0 |

| SUZ | 1 | 49875 | 1 |

| TWLO | 59 | 2213976 | 13 |

| FTS | 13 | 231336 | -1 |

| Average | 27.5 | 1053417 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.5 hedge funds with bullish positions and the average amount invested in these stocks was $1053 million. That figure was $207 million in ARE’s case. Twilio Inc. (NYSE:TWLO) is the most popular stock in this table. On the other hand Suzano S.A. (NYSE:SUZ) is the least popular one with only 1 bullish hedge fund positions. Alexandria Real Estate Equities Inc (NYSE:ARE) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on ARE, though not to the same extent, as the stock returned 4.9% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.