Hedge funds are not perfect. They have their bad picks just like everyone else. Facebook, a stock hedge funds have loved, lost nearly 40% of its value at one point in 2018. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 15 S&P 500 stocks among hedge funds at the end of December 2018 yielded an average return of 19.7% year-to-date, vs. a gain of 13.1% for the S&P 500 Index. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of Air Transport Services Group Inc. (NASDAQ:ATSG).

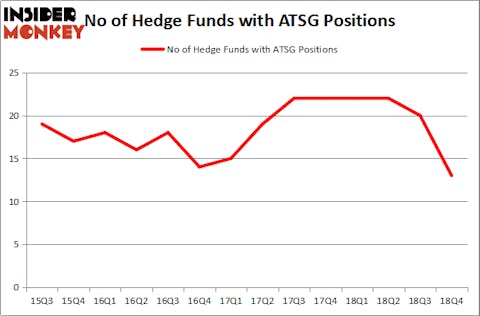

Air Transport Services Group Inc. (NASDAQ:ATSG) was in 13 hedge funds’ portfolios at the end of December. ATSG shareholders have witnessed a decrease in hedge fund interest recently. There were 20 hedge funds in our database with ATSG positions at the end of the previous quarter. Our calculations also showed that ATSG isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a gander at the key hedge fund action encompassing Air Transport Services Group Inc. (NASDAQ:ATSG).

What have hedge funds been doing with Air Transport Services Group Inc. (NASDAQ:ATSG)?

Heading into the first quarter of 2019, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of -35% from one quarter earlier. On the other hand, there were a total of 22 hedge funds with a bullish position in ATSG a year ago. With hedge funds’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

More specifically, Moab Capital Partners was the largest shareholder of Air Transport Services Group Inc. (NASDAQ:ATSG), with a stake worth $46.8 million reported as of the end of December. Trailing Moab Capital Partners was Private Capital Management, which amassed a stake valued at $30 million. Red Mountain Capital, ACK Asset Management, and D E Shaw were also very fond of the stock, giving the stock large weights in their portfolios.

Since Air Transport Services Group Inc. (NASDAQ:ATSG) has witnessed a decline in interest from the entirety of the hedge funds we track, it’s safe to say that there lies a certain “tier” of hedge funds who sold off their positions entirely in the third quarter. It’s worth mentioning that Israel Englander’s Millennium Management dumped the largest position of all the hedgies watched by Insider Monkey, valued at close to $32.6 million in stock. Ken Griffin’s fund, Citadel Investment Group, also cut its stock, about $4.9 million worth. These transactions are interesting, as aggregate hedge fund interest fell by 7 funds in the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Air Transport Services Group Inc. (NASDAQ:ATSG) but similarly valued. These stocks are Mueller Industries, Inc. (NYSE:MLI), Rush Enterprises, Inc. (NASDAQ:RUSHA), Kronos Worldwide, Inc. (NYSE:KRO), and Park National Corporation (NYSEAMEX:PRK). All of these stocks’ market caps are closest to ATSG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MLI | 10 | 142048 | -5 |

| RUSHA | 21 | 95354 | 1 |

| KRO | 14 | 38841 | -3 |

| PRK | 7 | 12521 | -5 |

| Average | 13 | 72191 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13 hedge funds with bullish positions and the average amount invested in these stocks was $72 million. That figure was $210 million in ATSG’s case. Rush Enterprises, Inc. (NASDAQ:RUSHA) is the most popular stock in this table. On the other hand Park National Corporation (NYSEAMEX:PRK) is the least popular one with only 7 bullish hedge fund positions. Air Transport Services Group Inc. (NASDAQ:ATSG) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately ATSG wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); ATSG investors were disappointed as the stock returned 2.3% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.