Looking for stocks with high upside potential? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 13.1% in the 2.5 months of 2019 (including dividend payments). Conversely, hedge funds’ 15 preferred S&P 500 stocks generated a return of 19.7% during the same period, with 93% of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like Hilltop Holdings Inc. (NYSE:HTH).

Hilltop Holdings Inc. (NYSE:HTH) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 14 hedge funds’ portfolios at the end of the fourth quarter of 2018. At the end of this article we will also compare HTH to other stocks including LCI Industries (NYSE:LCII), Allscripts Healthcare Solutions Inc (NASDAQ:MDRX), and Belden Inc. (NYSE:BDC) to get a better sense of its popularity.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to view the recent hedge fund action surrounding Hilltop Holdings Inc. (NYSE:HTH).

How have hedgies been trading Hilltop Holdings Inc. (NYSE:HTH)?

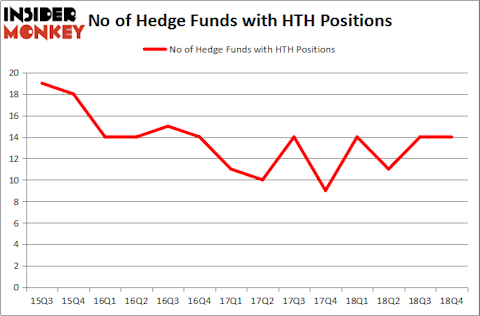

At Q4’s end, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in HTH over the last 14 quarters. With the smart money’s capital changing hands, there exists a select group of key hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

More specifically, Millennium Management was the largest shareholder of Hilltop Holdings Inc. (NYSE:HTH), with a stake worth $27.4 million reported as of the end of December. Trailing Millennium Management was Basswood Capital, which amassed a stake valued at $17.9 million. Royce & Associates, SCW Capital Management, and D E Shaw were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that Hilltop Holdings Inc. (NYSE:HTH) has experienced a decline in interest from the aggregate hedge fund industry, it’s safe to say that there was a specific group of hedgies that elected to cut their entire stakes in the third quarter. Intriguingly, Paul Magidson, Jonathan Cohen. And Ostrom Enders’s Castine Capital Management dumped the biggest stake of the “upper crust” of funds followed by Insider Monkey, worth about $2.4 million in stock, and Brandon Haley’s Holocene Advisors was right behind this move, as the fund said goodbye to about $0.7 million worth. These moves are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Hilltop Holdings Inc. (NYSE:HTH) but similarly valued. These stocks are LCI Industries (NYSE:LCII), Allscripts Healthcare Solutions Inc (NASDAQ:MDRX), Belden Inc. (NYSE:BDC), and Everbridge, Inc. (NASDAQ:EVBG). This group of stocks’ market values are closest to HTH’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LCII | 8 | 79865 | -4 |

| MDRX | 18 | 159101 | -2 |

| BDC | 15 | 40502 | 5 |

| EVBG | 22 | 251142 | 3 |

| Average | 15.75 | 132653 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.75 hedge funds with bullish positions and the average amount invested in these stocks was $133 million. That figure was $103 million in HTH’s case. Everbridge, Inc. (NASDAQ:EVBG) is the most popular stock in this table. On the other hand LCI Industries (NYSE:LCII) is the least popular one with only 8 bullish hedge fund positions. Hilltop Holdings Inc. (NYSE:HTH) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately HTH wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); HTH investors were disappointed as the stock returned 11.1% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.