At Insider Monkey we follow nearly 750 of the best-performing investors and even though many of them lost money in the last couple of months of 2018 (some actually delivered very strong returns), the history teaches us that over the long-run they still manage to beat the market, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following some of their picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

Hedge fund interest in Harmony Gold Mining Company Limited (NYSE:HMY) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Solid Biosciences Inc. (NASDAQ:SLDB), National Bank Holdings Corp (NYSE:NBHC), and The Buckle, Inc. (NYSE:BKE) to gather more data points.

To most traders, hedge funds are assumed to be slow, old investment vehicles of the past. While there are more than 8000 funds trading at present, Our experts choose to focus on the aristocrats of this group, around 750 funds. These hedge fund managers watch over the majority of the smart money’s total asset base, and by tailing their highest performing picks, Insider Monkey has revealed numerous investment strategies that have historically outstripped the market. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by nearly 5 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Cliff Asness of AQR Capital Management

Let’s take a gander at the key hedge fund action surrounding Harmony Gold Mining Company Limited (NYSE:HMY).

How are hedge funds trading Harmony Gold Mining Company Limited (NYSE:HMY)?

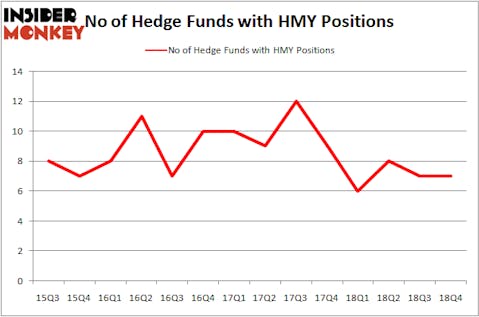

At Q4’s end, a total of 7 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in HMY over the last 14 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Jim Simons’s Renaissance Technologies has the number one position in Harmony Gold Mining Company Limited (NYSE:HMY), worth close to $9.7 million, corresponding to less than 0.1%% of its total 13F portfolio. Sitting at the No. 2 spot is Millennium Management, managed by Israel Englander, which holds a $4 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining peers with similar optimism comprise Cliff Asness’s AQR Capital Management, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and D. E. Shaw’s D E Shaw.

Judging by the fact that Harmony Gold Mining Company Limited (NYSE:HMY) has witnessed bearish sentiment from the entirety of the hedge funds we track, it’s easy to see that there is a sect of hedge funds that decided to sell off their entire stakes heading into Q3. Interestingly, Noam Gottesman’s GLG Partners sold off the biggest stake of the “upper crust” of funds monitored by Insider Monkey, valued at about $0.8 million in stock, and Ken Griffin’s Citadel Investment Group was right behind this move, as the fund sold off about $0.1 million worth. These transactions are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks similar to Harmony Gold Mining Company Limited (NYSE:HMY). We will take a look at Solid Biosciences Inc. (NASDAQ:SLDB), National Bank Holdings Corp (NYSE:NBHC), The Buckle, Inc. (NYSE:BKE), and Clovis Oncology Inc (NASDAQ:CLVS). This group of stocks’ market values match HMY’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SLDB | 11 | 284601 | -6 |

| NBHC | 10 | 86835 | 1 |

| BKE | 13 | 31406 | -2 |

| CLVS | 24 | 452155 | -8 |

| Average | 14.5 | 213749 | -3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.5 hedge funds with bullish positions and the average amount invested in these stocks was $214 million. That figure was $20 million in HMY’s case. Clovis Oncology Inc (NASDAQ:CLVS) is the most popular stock in this table. On the other hand National Bank Holdings Corp (NYSE:NBHC) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Harmony Gold Mining Company Limited (NYSE:HMY) is even less popular than NBHC. Hedge funds dodged a bullet by taking a bearish stance towards HMY. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately HMY wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); HMY investors were disappointed as the stock returned -0.6% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.