How do you pick the next stock to invest in? One way would be to spend hours of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding TG Therapeutics Inc (NASDAQ:TGTX).

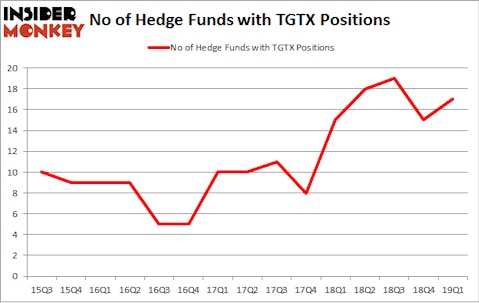

Is TG Therapeutics Inc (NASDAQ:TGTX) going to take off soon? The best stock pickers are buying. The number of bullish hedge fund positions moved up by 2 in recent months. Our calculations also showed that tgtx isn’t among the 30 most popular stocks among hedge funds.

According to most stock holders, hedge funds are seen as underperforming, outdated investment vehicles of yesteryear. While there are more than 8000 funds in operation at the moment, Our experts choose to focus on the moguls of this group, approximately 750 funds. These money managers handle the lion’s share of the hedge fund industry’s total asset base, and by following their highest performing picks, Insider Monkey has spotted many investment strategies that have historically outpaced the market. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by around 5 percentage points a year since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Let’s take a gander at the fresh hedge fund action encompassing TG Therapeutics Inc (NASDAQ:TGTX).

How have hedgies been trading TG Therapeutics Inc (NASDAQ:TGTX)?

At Q1’s end, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 13% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards TGTX over the last 15 quarters. With the smart money’s sentiment swirling, there exists an “upper tier” of key hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Peter Kolchinsky’s RA Capital Management has the biggest position in TG Therapeutics Inc (NASDAQ:TGTX), worth close to $65.9 million, amounting to 2.8% of its total 13F portfolio. On RA Capital Management’s heels is Israel Englander of Millennium Management, with a $39.4 million position; 0.1% of its 13F portfolio is allocated to the stock. Some other professional money managers with similar optimism consist of Roberto Mignone’s Bridger Management, James A. Silverman’s Opaleye Management and Steve Cohen’s Point72 Asset Management.

As aggregate interest increased, key hedge funds have been driving this bullishness. Point72 Asset Management, managed by Steve Cohen, established the most valuable position in TG Therapeutics Inc (NASDAQ:TGTX). Point72 Asset Management had $10.3 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also initiated a $8.2 million position during the quarter. The other funds with new positions in the stock are Noam Gottesman’s GLG Partners, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, and Efrem Kamen’s Pura Vida Investments.

Let’s now review hedge fund activity in other stocks similar to TG Therapeutics Inc (NASDAQ:TGTX). We will take a look at Luxfer Holdings PLC (NYSE:LXFR), Eros International plc (NYSE:EROS), Village Farms International, Inc. (NASDAQ:VFF), and Community Healthcare Trust Inc (NYSE:CHCT). All of these stocks’ market caps are similar to TGTX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LXFR | 14 | 115224 | 2 |

| EROS | 6 | 16932 | 2 |

| VFF | 3 | 1872 | 3 |

| CHCT | 9 | 79341 | 0 |

| Average | 8 | 53342 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8 hedge funds with bullish positions and the average amount invested in these stocks was $53 million. That figure was $182 million in TGTX’s case. Luxfer Holdings PLC (NYSE:LXFR) is the most popular stock in this table. On the other hand Village Farms International, Inc. (NASDAQ:VFF) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks TG Therapeutics Inc (NASDAQ:TGTX) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately TGTX wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on TGTX were disappointed as the stock returned -4.5% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.