Before we spend days researching a stock idea we like to take a look at how hedge funds and billionaire investors recently traded that stock. The S&P 500 Index ETF (SPY) lost 2.6% in the first two months of the second quarter. Ten out of 11 industry groups in the S&P 500 Index lost value in May. The average return of a randomly picked stock in the index was even worse (-3.6%). This means you (or a monkey throwing a dart) have less than an even chance of beating the market by randomly picking a stock. On the other hand, the top 20 most popular S&P 500 stocks among hedge funds not only generated positive returns but also outperformed the index by about 3 percentage points through May 30th. In this article, we will take a look at what hedge funds think about Modine Manufacturing Company (NYSE:MOD).

Hedge fund interest in Modine Manufacturing Company (NYSE:MOD) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Banc of California, Inc. (NYSE:BANC), Weatherford International plc (NYSE:WFT), and Ballard Power Systems Inc. (NASDAQ:BLDP) to gather more data points.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to view the latest hedge fund action regarding Modine Manufacturing Company (NYSE:MOD).

How are hedge funds trading Modine Manufacturing Company (NYSE:MOD)?

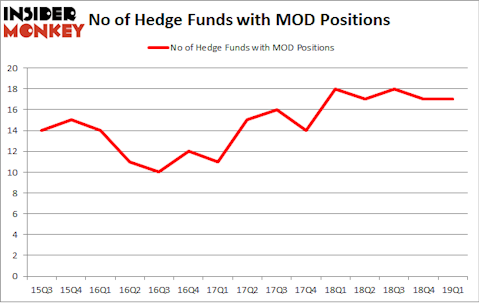

At the end of the first quarter, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in MOD over the last 15 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Mario Gabelli’s GAMCO Investors has the number one position in Modine Manufacturing Company (NYSE:MOD), worth close to $21.9 million, comprising 0.2% of its total 13F portfolio. Coming in second is Chuck Royce of Royce & Associates, with a $17.9 million position; 0.2% of its 13F portfolio is allocated to the stock. Remaining professional money managers that are bullish contain Douglas Dethy’s DC Capital Partners, D. E. Shaw’s D E Shaw and John Overdeck and David Siegel’s Two Sigma Advisors.

Since Modine Manufacturing Company (NYSE:MOD) has experienced falling interest from hedge fund managers, it’s safe to say that there lies a certain “tier” of money managers that slashed their full holdings last quarter. It’s worth mentioning that Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital cut the biggest stake of the 700 funds watched by Insider Monkey, comprising about $0.3 million in stock. Paul Marshall and Ian Wace’s fund, Marshall Wace LLP, also sold off its stock, about $0.3 million worth. These transactions are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks similar to Modine Manufacturing Company (NYSE:MOD). We will take a look at Banc of California, Inc. (NYSE:BANC), Weatherford International plc (NYSE:WFT), Ballard Power Systems Inc. (NASDAQ:BLDP), and ConnectOne Bancorp Inc (NASDAQ:CNOB). This group of stocks’ market values are closest to MOD’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BANC | 15 | 92220 | -2 |

| WFT | 15 | 38444 | -7 |

| BLDP | 3 | 367 | 1 |

| CNOB | 10 | 41185 | -2 |

| Average | 10.75 | 43054 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.75 hedge funds with bullish positions and the average amount invested in these stocks was $43 million. That figure was $70 million in MOD’s case. Banc of California, Inc. (NYSE:BANC) is the most popular stock in this table. On the other hand Ballard Power Systems Inc. (NASDAQ:BLDP) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Modine Manufacturing Company (NYSE:MOD) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately MOD wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on MOD were disappointed as the stock returned -1.7% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.