Baron Funds, an investment management company, released its “Baron Small Cap Fund” second-quarter 2023 investor letter. A copy of the same can be downloaded here. The fund was 6.49% (Institutional Shares) up in the second quarter and 16.54% up for the first half of the year. This quarter, the Fund underperformed the broader S&P 500 Index, as larger stocks beat smaller ones while, year-to-date the fund’s performance is comparable to the S&P 500 Index. The fund performed similarly to the Russell 2000 Growth Index (the Benchmark) during the quarter, and year-to-date the fund returned nearly 300 points ahead of the benchmark. In addition, please check the fund’s top five holdings to know its best picks in 2023.

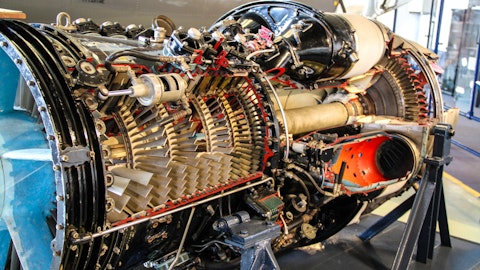

Baron Small Cap Fund highlighted stocks like Mercury Systems, Inc. (NASDAQ:MRCY) in the second quarter 2023 investor letter. Headquartered in Andover, Massachusetts, Mercury Systems, Inc. (NASDAQ:MRCY) is a technology company that serves defense and aerospace industries. On August 30, 2023, Mercury Systems, Inc. (NASDAQ:MRCY) stock closed at $39.61 per share. One-month return of Mercury Systems, Inc. (NASDAQ:MRCY) was 4.35%, and its shares lost 15.49% of their value over the last 52 weeks. Mercury Systems, Inc. (NASDAQ:MRCY) has a market capitalization of $2.305 billion.

Baron Small Cap Fund made the following comment about Mercury Systems, Inc. (NASDAQ:MRCY) in its second quarter 2023 investor letter:

“Shares of Mercury Systems, Inc. (NASDAQ:MRCY), a leading U.S. Tier 2 defense electronics integrator, declined in the quarter. The company suffered financial misses in 2022 and early 2023 due to delays in the government defense budget, and delivery failures by suppliers and other supply-chain issues. During this period, multiple activist investors bought shares of the company and acquired Board seats, pressing the company to pursue strategic alternatives. In late June, Mercury announced the process had ended without a sale and its long-time CEO was stepping down. The shares fell on the news. We were disappointed and sold some of our position. We have since spent some time with new management and Board members and see value above where the stock is trading, so we have maintained a position, albeit smaller, as we continue to assess the situation.”

Mercury Systems, Inc. (NASDAQ:MRCY) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 26 hedge fund portfolios held Mercury Systems, Inc. (NASDAQ:MRCY) at the end of second quarter which was 20 in the previous quarter.

We discussed Mercury Systems, Inc. (NASDAQ:MRCY) in another article and shared Aristotle Small Cap Equity Strategy’s views on the company. In addition, please check out our hedge fund investor letters Q2 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 20 Countries that Drink the Least Beer per Capita

- 15 Biggest Startup Failures in the World

- 35 Most Expensive Countries in the World To Live In

Disclosure: None. This article is originally published at Insider Monkey.