Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Cellectar Biosciences, Inc. (NASDAQ:CLRB).

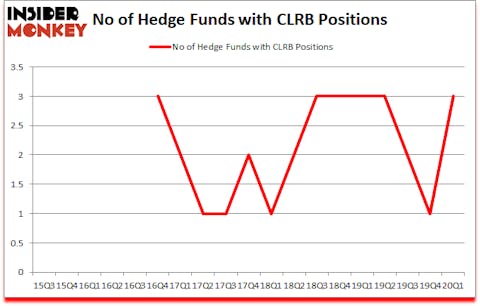

Cellectar Biosciences, Inc. (NASDAQ:CLRB) investors should be aware of an increase in activity from the world’s largest hedge funds in recent months. CLRB was in 3 hedge funds’ portfolios at the end of the first quarter of 2020. There were 1 hedge funds in our database with CLRB holdings at the end of the previous quarter. Our calculations also showed that CLRB isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are many indicators investors employ to size up stocks. A pair of the best indicators are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the best picks of the best investment managers can beat the market by a healthy amount (see the details here).

Jim Simons of Renaissance Technologies

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, legendary investor Bill Miller told investors to sell 7 extremely popular recession stocks last month. So, we went through his list and recommended another stock with 100% upside potential instead. We interview hedge fund managers and ask them about their best ideas. You can watch our latest hedge fund manager interview here and find out the name of the large-cap healthcare stock that Sio Capital’s Michael Castor expects to double. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now we’re going to go over the latest hedge fund action surrounding Cellectar Biosciences, Inc. (NASDAQ:CLRB).

How are hedge funds trading Cellectar Biosciences, Inc. (NASDAQ:CLRB)?

Heading into the second quarter of 2020, a total of 3 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 200% from the fourth quarter of 2019. Below, you can check out the change in hedge fund sentiment towards CLRB over the last 18 quarters. With hedge funds’ capital changing hands, there exists a few notable hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of Cellectar Biosciences, Inc. (NASDAQ:CLRB), with a stake worth $0.3 million reported as of the end of September. Trailing Renaissance Technologies was Sphera Global Healthcare Fund, which amassed a stake valued at $0.1 million. Citadel Investment Group was also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Sphera Global Healthcare Fund allocated the biggest weight to Cellectar Biosciences, Inc. (NASDAQ:CLRB), around 0.01% of its 13F portfolio. Renaissance Technologies is also relatively very bullish on the stock, dishing out 0.0003 percent of its 13F equity portfolio to CLRB.

As aggregate interest increased, key money managers have been driving this bullishness. Sphera Global Healthcare Fund, managed by Doron Breen and Mori Arkin, initiated the most outsized position in Cellectar Biosciences, Inc. (NASDAQ:CLRB). Sphera Global Healthcare Fund had $0.1 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also made a $0 million investment in the stock during the quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Cellectar Biosciences, Inc. (NASDAQ:CLRB) but similarly valued. These stocks are SigmaTron International (NASDAQ:SGMA), Inuvo, Inc. (NYSE:INUV), Euroseas Ltd. (NASDAQ:ESEA), and Unum Therapeutics Inc. (NASDAQ:UMRX). All of these stocks’ market caps are similar to CLRB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SGMA | 1 | 767 | 0 |

| INUV | 2 | 406 | 1 |

| ESEA | 1 | 83 | 0 |

| UMRX | 3 | 172 | 0 |

| Average | 1.75 | 357 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 1.75 hedge funds with bullish positions and the average amount invested in these stocks was $0 million. That figure was $0 million in CLRB’s case. Unum Therapeutics Inc. (NASDAQ:UMRX) is the most popular stock in this table. On the other hand SigmaTron International (NASDAQ:SGMA) is the least popular one with only 1 bullish hedge fund positions. Cellectar Biosciences, Inc. (NASDAQ:CLRB) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 7.9% in 2020 through May 22nd but beat the market by 15.6 percentage points. Unfortunately CLRB wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on CLRB were disappointed as the stock returned 6% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.