Legendary investors such as Jeffrey Talpins and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze BBVA Banco Frances S.A. (NYSE:BFR) from the perspective of those elite funds.

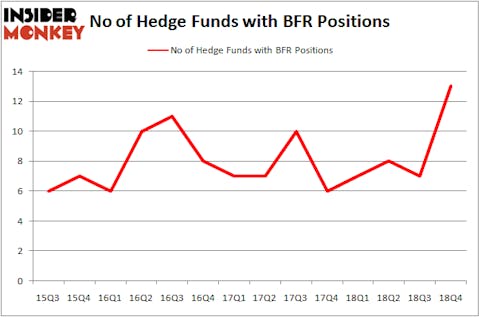

BBVA Banco Frances S.A. (NYSE:BFR) was in 13 hedge funds’ portfolios at the end of December. BFR shareholders have witnessed an increase in hedge fund sentiment recently. There were 7 hedge funds in our database with BFR holdings at the end of the previous quarter. Our calculations also showed that BFR isn’t among the 30 most popular stocks among hedge funds.

To most investors, hedge funds are seen as underperforming, outdated financial vehicles of yesteryear. While there are greater than 8000 funds in operation at present, We choose to focus on the aristocrats of this club, approximately 750 funds. These hedge fund managers watch over the majority of the smart money’s total asset base, and by monitoring their highest performing equity investments, Insider Monkey has come up with numerous investment strategies that have historically outrun Mr. Market. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by nearly 5 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to take a gander at the new hedge fund action encompassing BBVA Banco Frances S.A. (NYSE:BFR).

What does the smart money think about BBVA Banco Frances S.A. (NYSE:BFR)?

At the end of the fourth quarter, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 86% from the second quarter of 2018. By comparison, 7 hedge funds held shares or bullish call options in BFR a year ago. With hedgies’ capital changing hands, there exists a few noteworthy hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

The largest stake in BBVA Banco Frances S.A. (NYSE:BFR) was held by Horseman Capital Management, which reported holding $9.6 million worth of stock at the end of September. It was followed by Millennium Management with a $5.4 million position. Other investors bullish on the company included EMS Capital, Prince Street Capital Management, and LMR Partners.

As industrywide interest jumped, some big names were leading the bulls’ herd. Horseman Capital Management, managed by John Horseman, created the most outsized position in BBVA Banco Frances S.A. (NYSE:BFR). Horseman Capital Management had $9.6 million invested in the company at the end of the quarter. David Halpert’s Prince Street Capital Management also initiated a $3.6 million position during the quarter. The following funds were also among the new BFR investors: Robert Charles Gibbins’s Autonomy Capital, Jim Simons’s Renaissance Technologies, and Ken Griffin’s Citadel Investment Group.

Let’s now take a look at hedge fund activity in other stocks similar to BBVA Banco Frances S.A. (NYSE:BFR). These stocks are Repligen Corporation (NASDAQ:RGEN), Norbord Inc. (NYSE:OSB), SkyWest, Inc. (NASDAQ:SKYW), and Prospect Capital Corporation (NASDAQ:PSEC). This group of stocks’ market valuations match BFR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RGEN | 22 | 78494 | 10 |

| OSB | 7 | 18516 | -3 |

| SKYW | 13 | 139280 | -1 |

| PSEC | 11 | 29955 | 0 |

| Average | 13.25 | 66561 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.25 hedge funds with bullish positions and the average amount invested in these stocks was $67 million. That figure was $30 million in BFR’s case. Repligen Corporation (NASDAQ:RGEN) is the most popular stock in this table. On the other hand Norbord Inc. (NYSE:OSB) is the least popular one with only 7 bullish hedge fund positions. BBVA Banco Frances S.A. (NYSE:BFR) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately BFR wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); BFR investors were disappointed as the stock returned -23.8% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.