Jim Simons is one of the richest men on the planet. The reason is his high performing and highly envied hedge fund, Medallion Fund, which has not realized negative returns since 1990. Jim Simon’ Medallion Fund is the best hedge fund Insider Monkey has come across. In 2007, Simons returned 73% and in 2008 he returned 80%. The return is exceptional as such incomparably high returns were realized during the time of the financial crisis. We believe if he had started investing 20 years before he did, he would be the richest man on this planet today.

Jim Simons exploits market inefficiencies through high frequency trading. He makes use of algorithms to assist in execution of large orders. Consequentially, Medallion faces high expenses and transactions costs. This explains the higher than average performance fee of 44% that Medallion charges. However, the 44% fee is quite irrelevant considering the fact that the fund’s investors are current and past employees and their families. Jim Simons is the largest investor of Medallion and owns approximately 25-50 percent of Renaissance Technologies.

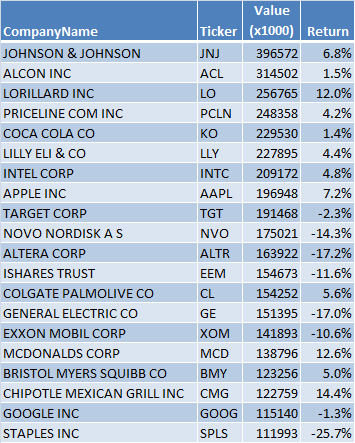

Jim Simons currently manages $24.85 billion. In the first quarter of 2011, Jim Simons reduced Lorillard Inc (LO) by 38%, Apple (AAPL) by 58%, Chipotle Mexican Grill (CMG) by 28%, and Google Inc (GOOG) by 27%. Since the end of March 2011, Lorillard Inc (LO) returned 12%, Apple (AAPL) returned 7.2%, and Chipotle Mexican Grill (CMG) gained 14.4% while Google Inc (GOOG) lost 1.3%. Here are Jim Simons’ top 20 stock positions at the end of March:

Johnson & Johnson (JNJ) makes up the largest portion of Jim Simons’ diversified portfolio. He increased JNJ by 21% in the quarter ending March 2011. He currently has 6.69 million shares of the company worth $396 million. JNJ returned 6.8% since the end of March. He has the largest position in the company after Warren Buffet. Warren Buffet’s Berkshire Hathaway has 42.62 million shares of JNJ, worth $2.5 billion. JNJ is among Warren Buffet’s top 10 holdings (See Buffet’s other bullish stocks).

In the first quarter of 2011, Jim Simons purchased Target Corp. As of now, he has 3.82 million shares of the company worth $191.4 million. Target returned -2.3% since March 2011. He has the largest position in Target Corp. The company makes up 0.77% of Simons’ current portfolio. Larry Robbins’ Glenview Capital has the second largest position. Robbins increased his Target holdings by 18% in the first quarter of 2011 (check out Larry Robbins’ top 20 stock holdings).

Lorillard (LO) returned 12% since the end of March. Jim Simons has the largest position in the company with 2.7 million shares valued at $256.7 million. Despite the decrease of Lorillard by 38% by Jim Simons in the first quarter, the company still makes up 1.03% of his portfolio. He also has the largest position in the company. Jean-Marie Eveillard’s First Eagle Investment Management has the second largest position with 2.29 million shares of Lorillard (see Jean-Marie Eveillard’s top stock picks).

Alcon Inc (ACL) was a merger arbitrage play which was acquired in April. Therefore, Alcon’s return is for only a few days. However, his remaining 19 stocks returned 0.3% since the end of March vs. a 9% loss for SPY. Jim Simons is very successful at picking winners this year. This is why he is beating the market. Keeping in mind his current and previous performance, we believe investors can beat the market by imitating his impressive stock picks.