Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of June. At Insider Monkey, we follow nearly 900 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Yext, Inc. (NYSE:YEXT), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

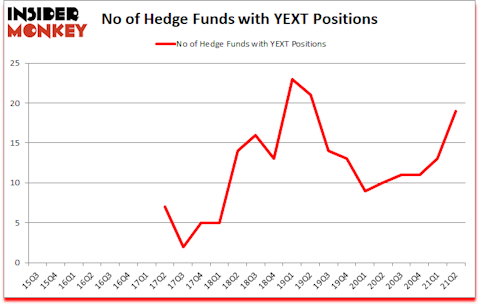

Is Yext, Inc. (NYSE:YEXT) a buy right now? Money managers were getting more optimistic. The number of bullish hedge fund positions increased by 6 recently. Yext, Inc. (NYSE:YEXT) was in 19 hedge funds’ portfolios at the end of June. The all time high for this statistic is 23. Our calculations also showed that YEXT isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings). There were 13 hedge funds in our database with YEXT holdings at the end of March.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 79 percentage points since March 2017 (see the details here). That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Michael Gelband of ExodusPoint Capital

With all of this in mind let’s take a glance at the new hedge fund action encompassing Yext, Inc. (NYSE:YEXT).

Do Hedge Funds Think YEXT Is A Good Stock To Buy Now?

At Q2’s end, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 46% from the previous quarter. On the other hand, there were a total of 10 hedge funds with a bullish position in YEXT a year ago. With the smart money’s capital changing hands, there exists an “upper tier” of notable hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

Among these funds, 0 held the most valuable stake in Yext, Inc. (NYSE:YEXT), which was worth $14.7 million at the end of the second quarter. On the second spot was Marshall Wace LLP which amassed $8.3 million worth of shares. Citadel Investment Group, GLG Partners, and Renaissance Technologies were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position PDT Partners allocated the biggest weight to Yext, Inc. (NYSE:YEXT), around 0.18% of its 13F portfolio. AlphaCrest Capital Management is also relatively very bullish on the stock, designating 0.09 percent of its 13F equity portfolio to YEXT.

As one would reasonably expect, key hedge funds have jumped into Yext, Inc. (NYSE:YEXT) headfirst. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, assembled the largest position in Yext, Inc. (NYSE:YEXT). Marshall Wace LLP had $8.3 million invested in the company at the end of the quarter. Renaissance Technologies also made a $3.7 million investment in the stock during the quarter. The following funds were also among the new YEXT investors: Michael Gelband’s ExodusPoint Capital, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Yext, Inc. (NYSE:YEXT) but similarly valued. These stocks are Argo Group International Holdings, Ltd. (NYSE:ARGO), Core Laboratories N.V. (NYSE:CLB), Lindsay Corporation (NYSE:LNN), QAD Inc. (NASDAQ:QADA), BioLife Solutions, Inc. (NASDAQ:BLFS), Pretium Resources Inc (NYSE:PVG), and The RealReal, Inc. (NASDAQ:REAL). This group of stocks’ market caps match YEXT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ARGO | 12 | 230220 | -1 |

| CLB | 16 | 238361 | -1 |

| LNN | 14 | 215504 | 4 |

| QADA | 23 | 230920 | 9 |

| BLFS | 9 | 474531 | -3 |

| PVG | 22 | 153956 | 0 |

| REAL | 26 | 342792 | 2 |

| Average | 17.4 | 269469 | 1.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.4 hedge funds with bullish positions and the average amount invested in these stocks was $269 million. That figure was $54 million in YEXT’s case. The RealReal, Inc. (NASDAQ:REAL) is the most popular stock in this table. On the other hand BioLife Solutions, Inc. (NASDAQ:BLFS) is the least popular one with only 9 bullish hedge fund positions. Yext, Inc. (NYSE:YEXT) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for YEXT is 64.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and beat the market again by 1.6 percentage points. Unfortunately YEXT wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on YEXT were disappointed as the stock returned -12.4% since the end of June (through 10/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Yext Inc. (NYSE:YEXT)

Follow Yext Inc. (NYSE:YEXT)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Wine Stocks to Invest in 2021

- 15 Most Valuable Australian Companies

- 20 Best Cities To Find A Husband

Disclosure: None. This article was originally published at Insider Monkey.