The worries about the election and the ongoing uncertainty about the path of interest-rate increases have been keeping investors on the sidelines. Of course, most hedge funds and other asset managers have been underperforming main stock market indices since the middle of 2015. Interestingly though, smaller-cap stocks registered their best performance relative to the large-capitalization stocks since the end of the June quarter, suggesting that this may be the best time to take a cue from their stock picks. In fact, the Russell 2000 Index gained more than 15% since the beginning of the third quarter, while the Standard and Poor’s 500 benchmark returned less than 6%. This article will lay out and discuss the hedge fund and institutional investor sentiment towards Western Alliance Bancorporation (NYSE:WAL) .

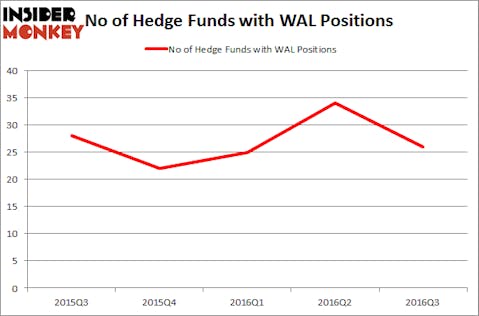

Is Western Alliance Bancorporation (NYSE:WAL) a healthy stock for your portfolio? The smart money is undoubtedly selling. The number of long hedge fund positions went down by 8 recently. There were 34 hedge funds in our database with WAL holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as RSP Permian Inc (NYSE:RSPP), Bright Horizons Family Solutions Inc (NYSE:BFAM), and Hudson Pacific Properties Inc (NYSE:HPP) to gather more data points.

Follow Western Alliance Bancorporation (NYSE:WAL)

Follow Western Alliance Bancorporation (NYSE:WAL)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

3d Pictures/Shutterstock.com

Now, let’s take a gander at the recent action encompassing Western Alliance Bancorporation (NYSE:WAL).

Hedge fund activity in Western Alliance Bancorporation (NYSE:WAL)

At Q3’s end, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -24% from the second quarter of 2016. On the other hand, there were a total of 22 hedge funds with a bullish position in WAL at the beginning of this year. With hedge funds’ sentiment swirling, there exists a select group of key hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Israel Englander’s Millennium Management has the biggest position in Western Alliance Bancorporation (NYSE:WAL), worth close to $70.4 million, comprising 0.1% of its total 13F portfolio. On Millennium Management’s heels is Sirios Capital Management, led by John Brennan, holding a $36.2 million position; 2% of its 13F portfolio is allocated to the company. Other professional money managers that hold long positions encompass Anand Parekh’s Alyeska Investment Group, Robert B. Gillam’s McKinley Capital Management and Ken Griffin’s Citadel Investment Group. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Due to the fact that Western Alliance Bancorporation (NYSE:WAL) has faced falling interest from the smart money, logic holds that there were a few hedge funds that elected to cut their entire stakes in the third quarter. Intriguingly, Anton Schutz’s Mendon Capital Advisors got rid of the biggest stake of all the investors watched by Insider Monkey, comprising close to $11.4 million in stock, and Benjamin A. Smith’s Laurion Capital Management was right behind this move, as the fund dropped about $5.9 million worth of shares.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Western Alliance Bancorporation (NYSE:WAL) but similarly valued. These stocks are RSP Permian Inc (NYSE:RSPP), Bright Horizons Family Solutions Inc (NYSE:BFAM), Hudson Pacific Properties Inc (NYSE:HPP), and Fibria Celulose SA (ADR) (NYSE:FBR). This group of stocks’ market caps are similar to WAL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RSPP | 31 | 285746 | 5 |

| BFAM | 12 | 86899 | -3 |

| HPP | 17 | 189409 | -6 |

| FBR | 7 | 39986 | -4 |

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $151 million. That figure was $250 million in WAL’s case. RSP Permian Inc (NYSE:RSPP) is the most popular stock in this table. On the other hand Fibria Celulose SA (ADR) (NYSE:FBR) is the least popular one with only 7 bullish hedge fund positions. Western Alliance Bancorporation (NYSE:WAL) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard RSPP might be a better candidate to consider taking a long position in.

Suggested Articles:

Biggest Construction Companies In The US

Highest Paying Jobs In The World

Theories About Illuminati and The New World Order

Disclosure: None