Is Watsco Inc (NYSE:WSO) a good bet right now? We like to analyze hedge fund sentiment before conducting days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

Is Watsco Inc (NYSE:WSO) a worthy investment now? Money managers are betting on the stock. The number of bullish hedge fund positions advanced by 4 recently. Our calculations also showed that WSO isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are several formulas market participants put to use to assess stocks. Some of the most useful formulas are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the top picks of the elite money managers can trounce the market by a superb margin (see the details here).

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a glance at the key hedge fund action encompassing Watsco Inc (NYSE:WSO).

Hedge fund activity in Watsco Inc (NYSE:WSO)

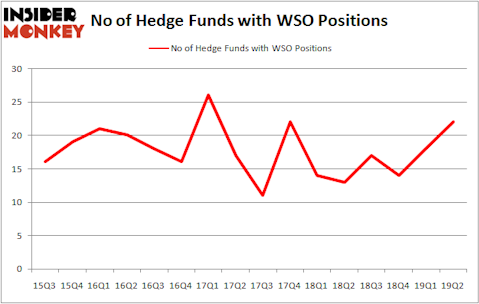

Heading into the third quarter of 2019, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a change of 22% from one quarter earlier. On the other hand, there were a total of 13 hedge funds with a bullish position in WSO a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Markel Gayner Asset Management held the most valuable stake in Watsco Inc (NYSE:WSO), which was worth $58.2 million at the end of the second quarter. On the second spot was Carlson Capital which amassed $50.9 million worth of shares. Moreover, Millennium Management, Balyasny Asset Management, and Scopus Asset Management were also bullish on Watsco Inc (NYSE:WSO), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, key money managers have been driving this bullishness. Carlson Capital, managed by Clint Carlson, created the most outsized position in Watsco Inc (NYSE:WSO). Carlson Capital had $50.9 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also made a $14.2 million investment in the stock during the quarter. The other funds with brand new WSO positions are Alexander Mitchell’s Scopus Asset Management, Matthew Hulsizer’s PEAK6 Capital Management, and Richard Driehaus’s Driehaus Capital.

Let’s check out hedge fund activity in other stocks similar to Watsco Inc (NYSE:WSO). These stocks are Haemonetics Corporation (NYSE:HAE), Cree, Inc. (NASDAQ:CREE), Farfetch Limited (NYSE:FTCH), and First American Financial Corp (NYSE:FAF). All of these stocks’ market caps resemble WSO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HAE | 23 | 762479 | -1 |

| CREE | 24 | 425587 | 10 |

| FTCH | 24 | 598527 | -19 |

| FAF | 34 | 772370 | 4 |

| Average | 26.25 | 639741 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.25 hedge funds with bullish positions and the average amount invested in these stocks was $640 million. That figure was $172 million in WSO’s case. First American Financial Corp (NYSE:FAF) is the most popular stock in this table. On the other hand Haemonetics Corporation (NYSE:HAE) is the least popular one with only 23 bullish hedge fund positions. Compared to these stocks Watsco Inc (NYSE:WSO) is even less popular than HAE. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on WSO, though not to the same extent, as the stock returned 4.5% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.