After a lengthy stretch of outperformance, small-cap stocks suffered from July 2015 through June 2016, as heightened global economic fears led investors to flee to the safe havens of large-cap stocks and other instruments. Those stocks outperformed small-caps by about 10 percentage points during that time, with small-cap healthcare stocks being particularly hard hit. However, the tide has since turned in a big way, as evidenced by small-caps toppling their large-cap peers by 5 percentage points in the third quarter, and by another 5 percentage points in the first seven weeks of the fourth quarter. In this article, we’ll analyze how this shift affected hedge funds’ Q3 trading of Vornado Realty Trust (NYSE:VNO) and see how the stock is affected by the recent hedge fund activity.

Is Vornado Realty Trust (NYSE:VNO) going to take off soon? Prominent investors are turning bullish. The number of long hedge fund bets inched up by 2 in recent months. At the end of this article we will also compare VNO to other stocks including M&T Bank Corporation (NYSE:MTB), Deutsche Bank AG (USA) (NYSE:DB), and Nielsen Hldg NV (NYSE:NLSN) to get a better sense of its popularity.

Follow Vornado Realty Trust (NYSE:VNO)

Follow Vornado Realty Trust (NYSE:VNO)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year, involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs.

g0d4ather / shutterstock.com

Keeping this in mind, let’s take a peek at the recent action encompassing Vornado Realty Trust (NYSE:VNO).

What have hedge funds been doing with Vornado Realty Trust (NYSE:VNO)?

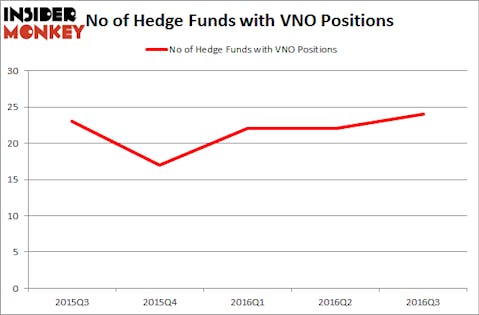

Heading into the fourth quarter of 2016, a total of 24 of the hedge funds tracked by Insider Monkey were bullish on this stock, an increase of 9% from the second quarter of 2016. With the smart money’s sentiment swirling, there exists a select group of key hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Third Avenue Management, run by Martin Whitman, holds the biggest position in Vornado Realty Trust (NYSE:VNO). According to regulatory filings, the fund has a $63.2 million position in the stock, comprising 2.9% of its 13F portfolio. Sitting at the No. 2 spot is AEW Capital Management, managed by Jeffrey Furber, which holds a $40.6 million position; the fund has 0.8% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors with similar optimism consist of John A. Levin’s Levin Capital Strategies, Phill Gross and Robert Atchinson’s Adage Capital Management and Eduardo Abush’s Waterfront Capital Partners.

Now, specific money managers have jumped into Vornado Realty Trust (NYSE:VNO) headfirst. Stevens Capital Management, led by Matthew Tewksbury, assembled the most outsized position in Vornado Realty Trust (NYSE:VNO). The fund reportedly had $3.6 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $2.5 million position during the quarter. The other funds with new positions in the stock are Richard Driehaus’s Driehaus Capital, Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners, and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Vornado Realty Trust (NYSE:VNO) but similarly valued. We will take a look at M&T Bank Corporation (NYSE:MTB), Deutsche Bank AG (USA) (NYSE:DB), Nielsen Hldg NV (NYSE:NLSN), and Level 3 Communications, Inc. (NYSE:LVLT). This group of stocks’ market valuations are closest to VNO’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MTB | 22 | 786073 | 4 |

| DB | 22 | 111790 | 7 |

| NLSN | 26 | 436451 | -3 |

| LVLT | 49 | 2788737 | 1 |

As you can see these stocks had an average of 30 hedge funds with bullish positions and the average amount invested in these stocks was $1.03 billion. That figure was a meager $264 million in VNO’s case. Level 3 Communications, Inc. (NYSE:LVLT) is the most popular stock in this table. On the other hand M&T Bank Corporation (NYSE:MTB) is the least popular one with only 22 bullish hedge fund positions. Vornado Realty Trust (NYSE:VNO) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard LVLT might be a better candidate to consider a long position.

Disclosure: none.