There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Jeff Ubben, George Soros and Carl Icahn think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other elite funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze United Continental Holdings Inc (NASDAQ:UAL).

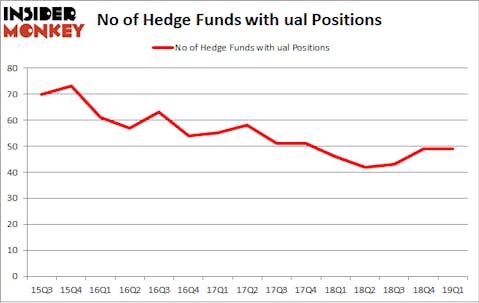

United Continental Holdings Inc (NASDAQ:UAL) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 49 hedge funds’ portfolios at the end of March. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Cintas Corporation (NASDAQ:CTAS), FleetCor Technologies, Inc. (NYSE:FLT), and Hewlett Packard Enterprise Company (NYSE:HPE) to gather more data points.

According to most shareholders, hedge funds are seen as slow, old financial tools of yesteryear. While there are over 8000 funds trading at present, Our experts choose to focus on the upper echelon of this group, about 750 funds. These hedge fund managers manage most of the smart money’s total asset base, and by watching their first-class stock picks, Insider Monkey has identified numerous investment strategies that have historically defeated Mr. Market. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by around 5 percentage points a year since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

Brad Gerstner of Altimeter Capital

We’re going to analyze the fresh hedge fund action encompassing United Continental Holdings Inc (NASDAQ:UAL).

Hedge fund activity in United Continental Holdings Inc (NASDAQ:UAL)

At Q1’s end, a total of 49 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the fourth quarter of 2018. On the other hand, there were a total of 46 hedge funds with a bullish position in UAL a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

The largest stake in United Continental Holdings Inc (NASDAQ:UAL) was held by Berkshire Hathaway, which reported holding $1750.3 million worth of stock at the end of March. It was followed by PAR Capital Management with a $1246.1 million position. Other investors bullish on the company included Altimeter Capital Management, Lansdowne Partners, and Diamond Hill Capital.

Since United Continental Holdings Inc (NASDAQ:UAL) has experienced bearish sentiment from the aggregate hedge fund industry, logic holds that there were a few money managers that elected to cut their entire stakes heading into Q3. At the top of the heap, Matt Simon (Citadel)’s Ashler Capital dumped the largest position of all the hedgies watched by Insider Monkey, comprising close to $45.9 million in call options. Benjamin A. Smith’s fund, Laurion Capital Management, also said goodbye to its call options, about $23 million worth. These transactions are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as United Continental Holdings Inc (NASDAQ:UAL) but similarly valued. These stocks are Cintas Corporation (NASDAQ:CTAS), FleetCor Technologies, Inc. (NYSE:FLT), Hewlett Packard Enterprise Company (NYSE:HPE), and Rockwell Automation Inc. (NYSE:ROK). This group of stocks’ market values resemble UAL’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CTAS | 27 | 525445 | -2 |

| FLT | 34 | 1733702 | 1 |

| HPE | 30 | 967419 | 1 |

| ROK | 28 | 534625 | -7 |

| Average | 29.75 | 940298 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.75 hedge funds with bullish positions and the average amount invested in these stocks was $940 million. That figure was $6334 million in UAL’s case. FleetCor Technologies, Inc. (NYSE:FLT) is the most popular stock in this table. On the other hand Cintas Corporation (NASDAQ:CTAS) is the least popular one with only 27 bullish hedge fund positions. Compared to these stocks United Continental Holdings Inc (NASDAQ:UAL) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on UAL, though not to the same extent, as the stock returned -0.4% during the same period and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.