Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility. The fourth quarter of 2018 is one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by nearly 7 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have seen some volatility in their portfolios too. Actually their moves are potentially one of the factors that contributed to this volatility. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of The Western Union Company (NYSE:WU).

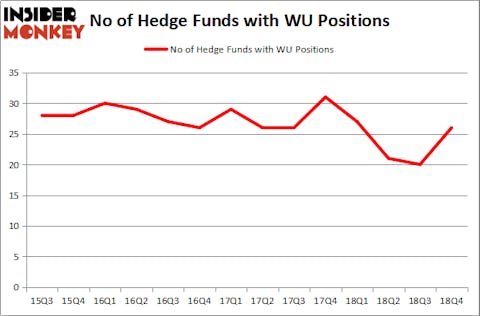

Is The Western Union Company (NYSE:WU) a buy right now? The smart money is turning bullish. The number of bullish hedge fund positions inched up by 6 in recent months. Our calculations also showed that WU isn’t among the 30 most popular stocks among hedge funds.

To most stock holders, hedge funds are seen as slow, old financial vehicles of yesteryear. While there are greater than 8000 funds trading at present, Our experts look at the upper echelon of this club, around 750 funds. These investment experts oversee bulk of all hedge funds’ total capital, and by observing their highest performing investments, Insider Monkey has discovered several investment strategies that have historically defeated the S&P 500 index. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by nearly 5 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s take a peek at the latest hedge fund action encompassing The Western Union Company (NYSE:WU).

Hedge fund activity in The Western Union Company (NYSE:WU)

Heading into the first quarter of 2019, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 30% from one quarter earlier. By comparison, 27 hedge funds held shares or bullish call options in WU a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, David Abrams’s Abrams Capital Management has the number one position in The Western Union Company (NYSE:WU), worth close to $178 million, amounting to 7.4% of its total 13F portfolio. Coming in second is John W. Rogers of Ariel Investments, with a $38.6 million position; 0.5% of its 13F portfolio is allocated to the company. Remaining members of the smart money that are bullish encompass Bernard Horn’s Polaris Capital Management, David Harding’s Winton Capital Management and D. E. Shaw’s D E Shaw.

Consequently, key hedge funds were breaking ground themselves. Garelick Capital Partners, managed by Bruce Garelick, established the most valuable position in The Western Union Company (NYSE:WU). Garelick Capital Partners had $8.9 million invested in the company at the end of the quarter. Joel Greenblatt’s Gotham Asset Management also made a $7.8 million investment in the stock during the quarter. The other funds with new positions in the stock are Minhua Zhang’s Weld Capital Management, Jeffrey Talpins’s Element Capital Management, and Cliff Asness’s AQR Capital Management.

Let’s check out hedge fund activity in other stocks similar to The Western Union Company (NYSE:WU). These stocks are LKQ Corporation (NASDAQ:LKQ), Bunge Limited (NYSE:BG), Ultrapar Participacoes SA (NYSE:UGP), and CPFL Energia S.A. (NYSE:CPL). This group of stocks’ market valuations are closest to WU’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LKQ | 40 | 878260 | -5 |

| BG | 38 | 874746 | -1 |

| UGP | 3 | 49830 | -5 |

| CPL | 2 | 15394 | 0 |

| Average | 20.75 | 454558 | -2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.75 hedge funds with bullish positions and the average amount invested in these stocks was $455 million. That figure was $446 million in WU’s case. LKQ Corporation (NASDAQ:LKQ) is the most popular stock in this table. On the other hand CPFL Energia S.A. (NYSE:CPL) is the least popular one with only 2 bullish hedge fund positions. The Western Union Company (NYSE:WU) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Unfortunately WU wasn’t in this group. Hedge funds that bet on WU were disappointed as the stock returned 15.4% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 12 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.