In this article we will take a look at whether hedge funds think The RealReal, Inc. (NASDAQ:REAL) is a good investment right now. We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, unconventional data sources, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

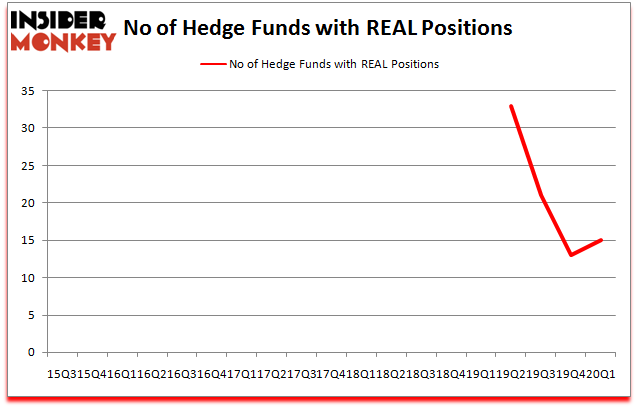

The RealReal, Inc. (NASDAQ:REAL) investors should pay attention to an increase in enthusiasm from smart money in recent months. REAL was in 15 hedge funds’ portfolios at the end of the first quarter of 2020. There were 13 hedge funds in our database with REAL holdings at the end of the previous quarter. Our calculations also showed that REAL isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are a multitude of formulas shareholders have at their disposal to appraise their holdings. Some of the most innovative formulas are hedge fund and insider trading interest. We have shown that, historically, those who follow the best picks of the best hedge fund managers can outpace their index-focused peers by a solid amount (see the details here).

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, blockchain technology’s influence will go beyond online payments. So, we are checking out this futurist’s moonshot opportunities in tech stocks. We interview hedge fund managers and ask them about their best ideas. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. For example we are checking out stocks recommended/scorned by legendary Bill Miller. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind we’re going to review the key hedge fund action encompassing The RealReal, Inc. (NASDAQ:REAL).

What does smart money think about The RealReal, Inc. (NASDAQ:REAL)?

At the end of the first quarter, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 15% from one quarter earlier. By comparison, 0 hedge funds held shares or bullish call options in REAL a year ago. With hedgies’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, C. Ashton Newhall and James Lim’s Greenspring Associates has the largest position in The RealReal, Inc. (NASDAQ:REAL), worth close to $33.3 million, comprising 13.8% of its total 13F portfolio. On Greenspring Associates’s heels is Woodson Capital Management, led by James Woodson Davis, holding a $14.7 million position; 2.1% of its 13F portfolio is allocated to the company. Some other hedge funds and institutional investors that are bullish contain Hyder Ahmad’s Broad Peak Investment Holdings, Angela Aldrich’s Bayberry Capital Partners and Paul Marshall and Ian Wace’s Marshall Wace LLP. In terms of the portfolio weights assigned to each position Greenspring Associates allocated the biggest weight to The RealReal, Inc. (NASDAQ:REAL), around 13.77% of its 13F portfolio. Bayberry Capital Partners is also relatively very bullish on the stock, designating 3.04 percent of its 13F equity portfolio to REAL.

As aggregate interest increased, specific money managers have jumped into The RealReal, Inc. (NASDAQ:REAL) headfirst. Woodson Capital Management, managed by James Woodson Davis, assembled the biggest position in The RealReal, Inc. (NASDAQ:REAL). Woodson Capital Management had $14.7 million invested in the company at the end of the quarter. Hyder Ahmad’s Broad Peak Investment Holdings also made a $11.9 million investment in the stock during the quarter. The other funds with new positions in the stock are Anthony Bozza’s Lakewood Capital Management, John Overdeck and David Siegel’s Two Sigma Advisors, and Sander Gerber’s Hudson Bay Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as The RealReal, Inc. (NASDAQ:REAL) but similarly valued. These stocks are Radius Health Inc (NASDAQ:RDUS), Revolve Group, Inc. (NYSE:RVLV), Inseego Corp. (NASDAQ:INSG), and BELLUS Health Inc. (NASDAQ:BLU). All of these stocks’ market caps are similar to REAL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RDUS | 23 | 111468 | 1 |

| RVLV | 10 | 11180 | -1 |

| INSG | 12 | 18676 | 4 |

| BLU | 14 | 156516 | -2 |

| Average | 14.75 | 74460 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.75 hedge funds with bullish positions and the average amount invested in these stocks was $74 million. That figure was $79 million in REAL’s case. Radius Health Inc (NASDAQ:RDUS) is the most popular stock in this table. On the other hand Revolve Group, Inc. (NYSE:RVLV) is the least popular one with only 10 bullish hedge fund positions. The RealReal, Inc. (NASDAQ:REAL) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 13.3% in 2020 through June 25th but still beat the market by 16.8 percentage points. Hedge funds were also right about betting on REAL as the stock returned 105.4% in Q2 (through June 25th) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Therealreal Inc. (NASDAQ:REAL)

Follow Therealreal Inc. (NASDAQ:REAL)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.