The 800+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the second quarter, which unveil their equity positions as of September 30th. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards The ODP Corporation (NASDAQ:ODP).

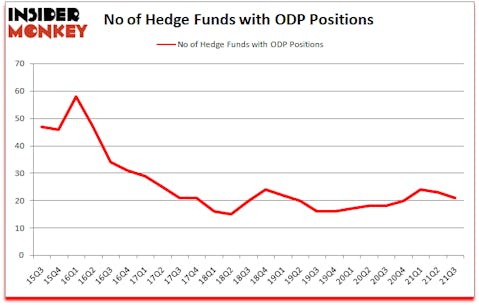

The ODP Corporation (NASDAQ:ODP) was in 21 hedge funds’ portfolios at the end of the third quarter of 2021. The all time high for this statistic is 58. ODP investors should be aware of a decrease in hedge fund interest of late. There were 23 hedge funds in our database with ODP positions at the end of the second quarter. Our calculations also showed that ODP isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Keeping this in mind let’s view the recent hedge fund action regarding The ODP Corporation (NASDAQ:ODP).

Joshua Friedman of Canyon Capital Advisors

Do Hedge Funds Think ODP Is A Good Stock To Buy Now?

Heading into the fourth quarter of 2021, a total of 21 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -9% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ODP over the last 25 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

The largest stake in The ODP Corporation (NASDAQ:ODP) was held by HG Vora Capital Management, which reported holding $200.8 million worth of stock at the end of September. It was followed by Canyon Capital Advisors with a $47.2 million position. Other investors bullish on the company included Greenlight Capital, Cannell Capital, and Arrowstreet Capital. In terms of the portfolio weights assigned to each position HG Vora Capital Management allocated the biggest weight to The ODP Corporation (NASDAQ:ODP), around 7.61% of its 13F portfolio. Alta Fundamental Advisers is also relatively very bullish on the stock, dishing out 6 percent of its 13F equity portfolio to ODP.

Since The ODP Corporation (NASDAQ:ODP) has witnessed declining sentiment from the entirety of the hedge funds we track, we can see that there were a few hedgies who were dropping their full holdings by the end of the third quarter. Intriguingly, Benjamin Natter’s Kent Lake Capital said goodbye to the biggest stake of the 750 funds watched by Insider Monkey, valued at about $4.8 million in stock. Jordan Moelis and Jeff Farroni’s fund, Deep Field Asset Management, also sold off its stock, about $4.5 million worth. These transactions are important to note, as aggregate hedge fund interest was cut by 2 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks similar to The ODP Corporation (NASDAQ:ODP). These stocks are AeroVironment, Inc. (NASDAQ:AVAV), Independence Realty Trust Inc (NYSE:IRT), Archer Aviation Inc. (NYSE:ACHR), Rover Group Inc. (NASDAQ:ROVR), World Fuel Services Corporation (NYSE:INT), ACM Research, Inc. (NASDAQ:ACMR), and Telecom Argentina S.A. (NYSE:TEO). This group of stocks’ market values resemble ODP’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AVAV | 15 | 134296 | -5 |

| IRT | 13 | 168372 | 4 |

| ACHR | 28 | 173531 | 28 |

| ROVR | 18 | 252392 | 18 |

| INT | 14 | 84634 | 0 |

| ACMR | 16 | 247211 | -2 |

| TEO | 11 | 36363 | -2 |

| Average | 16.4 | 156686 | 5.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.4 hedge funds with bullish positions and the average amount invested in these stocks was $157 million. That figure was $430 million in ODP’s case. Archer Aviation Inc. (NYSE:ACHR) is the most popular stock in this table. On the other hand Telecom Argentina S.A. (NYSE:TEO) is the least popular one with only 11 bullish hedge fund positions. The ODP Corporation (NASDAQ:ODP) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for ODP is 43.3. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 29.6% in 2021 and beat the market again by 3.6 percentage points. Unfortunately ODP wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on ODP were disappointed as the stock returned -2.2% since the end of September (through 12/31) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Odp Corp (NASDAQ:ODP)

Follow Odp Corp (NASDAQ:ODP)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Cheapest Online Shopping Sites in USA

- 10 Best Oil Stocks to Buy Amid Post-COVID Demand Boom and Price Volatility

- 15 Largest Cement Companies in the World

Disclosure: None. This article was originally published at Insider Monkey.